Choking lungs and public finances

A reduction in carbon emissions is badly needed, but there are also pressures to raise funds from fuel duty

30 June 2017

Road transport in the UK is a mess. The sector is fundamentally failing to meet the major challenges facing the UK economy. Whilst carbon emissions are falling across almost every sector of the UK economy, for transport they haven’t budged and risk blowing the UK’s carbon budgets. At the same time, the fiscal structure of road transport is in jeopardy by relying on fuel duties. A new report argues that fuel duty can either generate tax revenues or incentivise cleaner transport by discouraging people from driving. But a look at recent policy changes reveals current government actions set us up for neither.

The Committee for Climate Change – the Government’s official advisors on carbon reduction – emphasises that to effectively meet our 2030 carbon budget, a 44% reduction in transport emissions is required, which “will require a major increase in the uptake of electric vehicles.” The Office for Budget Responsibility, however, forecasts that returns from fuel duty will increase in the future and continue to provide a large source of tax receipts – currently 4%. But which is it? Are we going to continue driving and relying on fossil fuels for tax revenues while busting through the UK’s carbon budget? Or will we switch over to electric vehicles and stay within the carbon budget, thus creating a black hole in public finances? Both government bodies can’t be right.

Unfortunately for us, they might both be wrong. Given how the government is currently handling fuel duty, we may be on course to bust through the carbon budget for transport and create a black hole in public finances.

Beginning in 1993, fuel duty escalated faster than inflation, deliberately increased to raise revenues and incentivise behaviour relating to road wear and tear, local air pollutants, congestion, carbon emissions and road accidents. Then, as part of the 2011 budget, then Chancellor George Osborne announced a freeze in fuel duty. This was a temporary measure to provide relief to motorists, especially as fuel prices were quickly rising, and was scheduled to once again increase the following year.

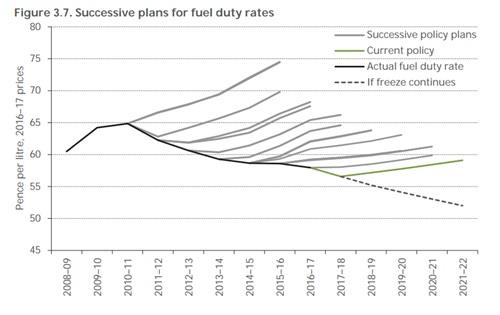

That didn’t happen. Instead, the fuel duty freeze has been ‘temporarily’ extended time and time again, even as fuel prices plummeted at the end of 2014 and still remain low. This series of freezes – effectively cuts, as inflation rises – has cost the Exchequer a whopping £30 billion. Back in March, Chancellor Phillip Hammond once again confirmed that the fuel duty freeze would be extended.

This confused mess of signalling has resulted in the ‘hedgehog’ formation of expected tax increases that never come and a rate that is actually falling in real terms.

It’s little wonder then that the necessary transformation of road transport is so slow. We are neither providing the incentives nor funding the programmes that are required.

A recent paper about public financing through fuel taxes makes the interesting suggestion that as carbon taxes are likely to become a major source of government revenue in the future, we may be creating the perverse incentive for those in government to avoid emission reduction policies as they would lower tax receipts.

This idea, like the concern about fuel duties versus carbon budgets, presents an intriguing catch-22 — but it’s not clear that policymakers actually operate in this manner. In reality, motorists are very much in the driver’s seat when it comes to political decision making. Until this grip is broken, we’ve got a bumpy ride ahead of us.

Topics Climate change Environment Transport