Who wins when we change the tax system?

Tax changes might be high on the agenda of the next government. What effect will they have?

27 June 2019

Tax cuts have emerged as a hot topic in the contest to become the next Prime Minister. Four out of the final five candidates – including the remaining two candidates– proposed sweeping changes to income tax and employee national insurance contributions (NICs). These included cuts to the basic rate of income tax (Sajid Javid and Dominic Raab), increasing the lower threshold for NICs (Jeremy Hunt, Boris Johnson and Dominic Raab) and increasing the higher thresholds for both income tax and NICs (Boris Johnson). As such big talking points in the recent debates, these tax changes could be high on the agenda of the next government.

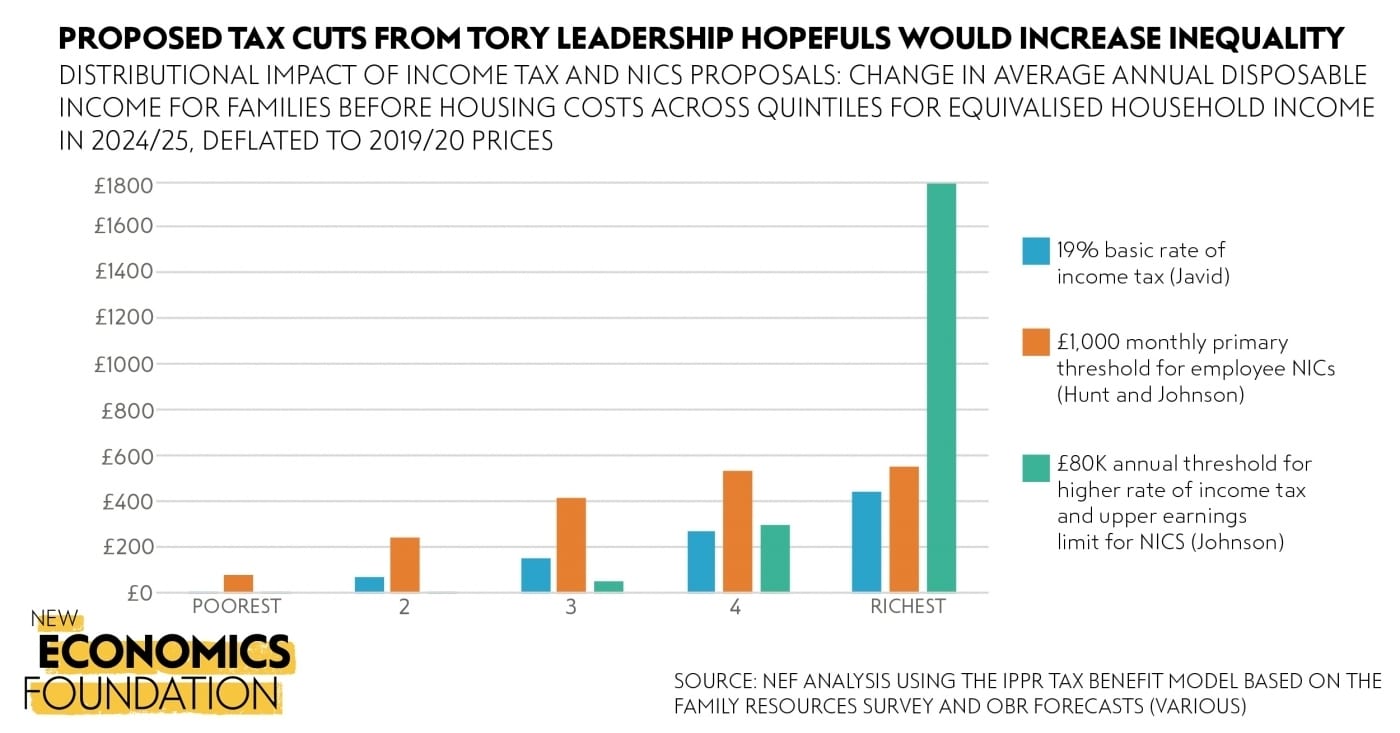

So what effect might these changes have? Our recent analysis shows that the proposed reforms would benefit the UK’s richest 20% of families at least seven times more than the poorest 20%. The chart below illustrates our findings that:

- Increasing the monthly primary threshold of NICs to £1,000 would increase disposable incomes by £560 for the richest 20% of families and £80 for the poorest 20%, at a cost £8.2bn a year.

- Cutting the basic rate of income tax by one percentage point would increase annual incomes for the richest families by £450 compared with just £10 for the poorest, and at a cost of £4.4bn.

- Increasing the annual threshold for the higher rate of income tax and the upper earnings limit for NICS from £50,000 to £80,000 would cost £9.5bn a year, with the richest families seeing gains of £1,790 a year compared with no increase in incomes for the poorest.

Figure 1 – Distributional effects of income tax and NICs proposals

Change in annual disposable family income before housing costs across deciles for equivalised household income in 2024/25, deflated to 2019/20 prices

So why does all this matter, especially if nobody is actually losing out in cash terms?

Firstly, our modelling showed that these reforms would increase inequality for two main reasons:

- Families with little or no taxable income, making up the majority of the UK’s poorest households, miss out on most of the benefits altogether.

- Families with two or more people with taxable income, which tend to be higher up the income distribution on average, will receive at least double the benefits from the proposed tax cuts compared to families with just one person in work.

Secondly, the changes would also increase the number of families in relative poverty, likely by 50,000 or more. Relative poverty refers to families below 60% of median equivalised household income after housing costs in a given year (see here for an explanation from the ONS and this Parliament briefing). As median incomes rise, the costs of living also tend to rise and these typically hit those in lowest incomes the hardest, since they spend most, if not all of their money on essentials like food, housing and transport.

And thirdly, there is the cost of tax cuts themselves. To pay for tax cuts, government must do one of three things: spending cuts, increase taxes elsewhere or increase borrowing. Cuts in spending of the required order of magnitude would likely impact public services significantly, compounding the effects of a decade of austerity and increased need from an aging population. Increasing other taxes would appear unlikely if not almost impossible as candidates have made commitments elsewhere to cut other major taxes, leaving few remaining options to raise the necessary funds. And increased borrowing would effectively mean asking future generations to bear the costs of large giveaways to the richest people alive today.

So what are the alternatives? NEF’s recent proposal suggested scrapping the personal allowance of income tax and replacing it with a Weekly National Allowance made up of a payment to most adults of £48 a week and an increase in child benefit. Such a change could be implemented at no net fiscal cost but would redistribute around £8bn a year from the 35% highest income households to the remaining 65%.

Our current tax system is already failing those on low incomes and reform is long overdue, but the reforms proposed by Conservative leadership hopefuls would increase inequality and relative poverty while costing the Treasury billions in foregone tax receipts. In a society already divided by Brexit and austerity, where average earnings are still failing to recover more than 10 years on from the financial crisis and where low-paid work encompasses one in six workers the government should strive to reduce economic disparities, not deepen them further.

Image: Unsplash

Topics Inequality