Scrap personal allowance and replace with a new weekly cash payment

New Economics Foundation proposes the creation of a new Weekly National Allowance for all adults earning under £125,000 a year

11 March 2019

If the Government abolished the personal allowance of income tax and replaced it with a weekly cash payment of £48 a week they could lift 200,000 families out of poverty, according to a new report by the New Economics Foundation (NEF) published today. Overall, the proposed policy swap would shift £8bn currently spent on tax allowances for the 35% highest income families to the remaining 65% of families.

At the Spring Statement this week the Chancellor will reaffirm the Government’s commitment to the personal tax allowance by raising the threshold to £12,500. In total, the personal allowance is estimated to cost £111.2bn in 2019/20 alone. The report proposes using this money to fund the Weekly National Allowance, made up of a new weekly payment worth £2500 per year and paid to everyone outside of the richest 1%, and a restoration of child benefit to its 2010/11 real terms value.

The proposal is entirely cost neutral . But the poorest 10% of households on average would see an increase in disposable income of £1,160 per year or around £20 per week, equal to a 15.8% increase. On average, every major family type among the poorest 25% of households would see their income rise – whether a single or couple adult family, with or without children (including families with four or more children), in or out of work, or above or below the pension age.

The report uses new modelling to compare this with the current personal allowance of income tax, which will reduce tax liabilities for the 10% richest families by almost £6500 in 2019/20 alone, compared with just £600 for the poorest 10%.

The proposed Weekly National Allowance would be:

- Highly redistributive: the net distributional effect of the Weekly National Allowance is to shift around £8bn currently spent on tax allowances for the 35% highest income families and reallocate this to the remaining 65% of families via the Weekly National Allowance.

- Fiscally neutral: the Weekly National Allowance repurposes the £111.2bn (projected figure for 2019/20 based on NEF modelling using HMRC, OBR and ONS data) already spent annually on the personal allowance of income tax and recycles this money into a new weekly payment made to every adult over the age of 18 at a total cost of £126.8bn, and an increase in child benefit costing £2.1 billion. The cost of means-tested benefits would fall by £20.6 billion since the new weekly payment will boost post tax income for the lowest income families.

- Improved macroeconomic stabilisation: The Weekly National Allowance would significantly improve the UK’s recession fighting toolkit. Converting the personal allowance into an equivalent weekly payment alone would represent a 66% increase on existing job seeker’s allowance. Because the Weekly National Allowance would be retained by everyone whether in or out of work, a higher proportion of it would be spent during a recession than in normal times, leading to an automatic boost to the economy when it was most needed.

The report includes distributional modelling and sensitivity testing of the policy shows which shows that the average increase in disposable income for the poorest households is comprehensive across all major family types. Some examples of how it will impact different family types include:

- A single unemployed adult on Universal Credit

This household would see their net disposable income rise by between £925 and £2500 per year.

- A teacher earning £30,000 and a part-time nurse earning £8000 with one child – receiving no universal credit

Overall, this household would see their disposable income rise by £1,118.4 per year, with £900 of this being paid directly to the second earner.

- A engineer earning £90,000 and receiving no universal credit

Overall, this household would see their disposable income fall by £2,500 per year. However, this household has already benefitted from reduced tax liabilities worth around £1,500 per year from the conservative government’s increases to the higher rate threshold since 2015.

Alfie Stirling, Head of Economics at the New Economics Foundation, said:

“The persistent increases to the personal allowance of income tax seen over the past decade represent one of the most expensive and regressive public spending initiatives of the 21st century so far. Costing more than the whole of defence, local government and the department for transport combined, and enriching the highest income households almost seven times faster than the poorest. It is time for policy makers to put those resources to better use.

“Repurposing the funds from the personal allowance into a new Weekly National Allowance, paid to everyone outside of the richest 1%, would significantly improve upon the UK’s social security system at a time when the botched rollout of Universal Credit is otherwise causing acute financial hardship and misery.

“With Brexit among a number of recessionary threats on the horizon, the Weekly National Allowance would not only help to shield families from the worst effects of recession, but would also aid future recovery by maintaining a minimum level of income and spending in the economy.”

Contact

Sofie Jenkinson, sofie.jenkinson@neweconomics.org 07981023031

Notes to Editors

The report ‘Nothing Personal: Replacing the personal tax allowance with a Weekly National Allowance’ can be found here: https://neweconomics.org/2019/03/nothing-personal

In 2019, NEF became a research partner on the IPPR tax and benefit model. The model uses micro data from the 2016/17 Family Resources Survey (FRS) – a dedicated survey for tax and benefit microsimulation modelling commissioned by DWP – and combines this with outturn and forecast estimates for key economic aggregates (such as interest rates and average earnings) from the Office for National statistics and Office for Budget Responsibility, respectively. The model works by simulating new scenarios for the UK labour market, earned and unearned income and tax and social security. The model estimates the impacts of policy change, including a breakdown of fiscal effects (changes to government expenditure and receipts), distributional impacts across family incomes and the implications for various measures of inequality and poverty. The model is capable of accurately estimating interactions and co-dependencies within different elements of tax and means-tested benefits, but it does not attempt to estimate behavioural effects.

Why is the personal allowance so regressive?

The personal allowance is designed to protect an individual’s initial income from personal taxation (although earnings from work below this level can still accrue liabilities under national insurance contributions) and is scheduled to apply to the first £12,500 in income for the 2019/20 financial year. But those families with little or no taxable income, who make up the majority of the UK’s poorest households, by definition miss out on the benefits of a higher tax allowance altogether. Meanwhile, families with two or more people receiving a taxable income – which tend to be higher up the income distribution on average – can receive twice the benefit or more. On top of this, the personal allowance is also worth double for individuals with pre-tax incomes above the ‘higher rate threshold’ – the level beyond which additional income gets taxed at a rate of 40%, and set at £50,000 for 2019/20. This is because the higher rate threshold is defined as a specified amount above the personal allowance, so the threshold rises pound-for-pound automatically for any increase in the allowance. However, gains for the richest 5% of households are limited by the fact that the personal allowance is gradually withdrawn for annual incomes above £100,000.

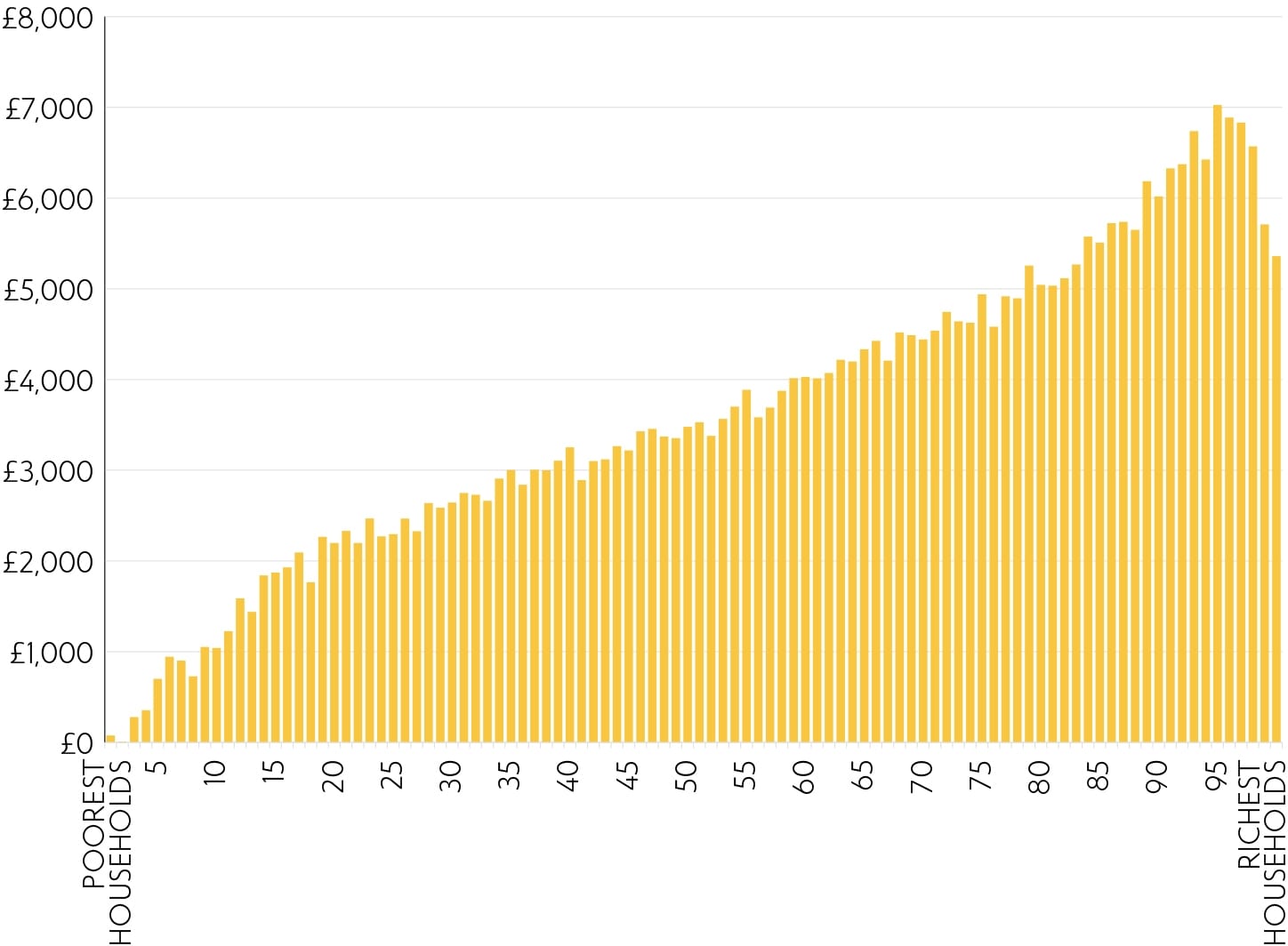

CURRENT POLICY

The personal allowance distributes more than £100 billion in foregone tax receipts every year, with the largest gains flowing to the highest income households

Distributional effects of the personal allowance of income tax: Change in disposable family income before housing costs across percentiles for equivalised household income, 2019/20

Source: Authors’ analysis using the IPPR tax and benefit model based on data from the ONS and OBR (various) and the 2016/17 Family Resources Survey

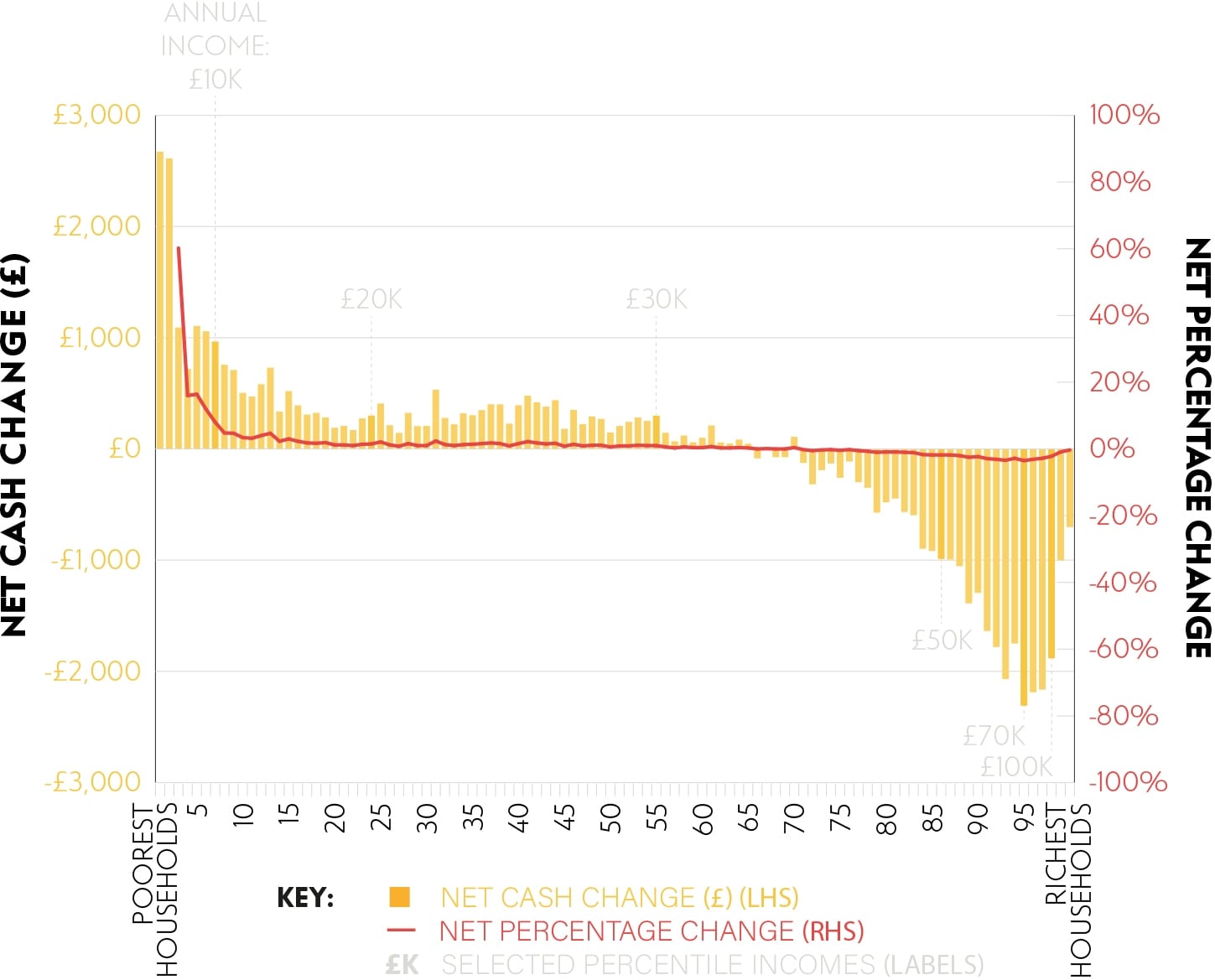

PROPOSED POLICY

The Weekly National Allowance redistributes around 8bn annually from the 35% highest income households to the remaining 65%, with gains and losses concentrated at the respective extremes of the household income distribution

Distributional effects of the NEF Weekly National Allowance: change in disposable family income before housing costs across percentiles for equivalised household income, 2019/20

Source: Authors’ analysis using the IPPR tax and benefit model based on data from the ONS and OBR (various) and the 2016/17 Family Resources Survey.

NB: We do not report values for the series for ‘net percentage change’ below the 3rd percentile because incomes below this level are extremely small or negative