Johnson, Hunt and Javid’s tax proposals would increase the number of families in poverty by at least 50,000

New modelling from the NEF shows that proposed tax cuts from Tory leadership hopefuls would increase inequality

19 June 2019

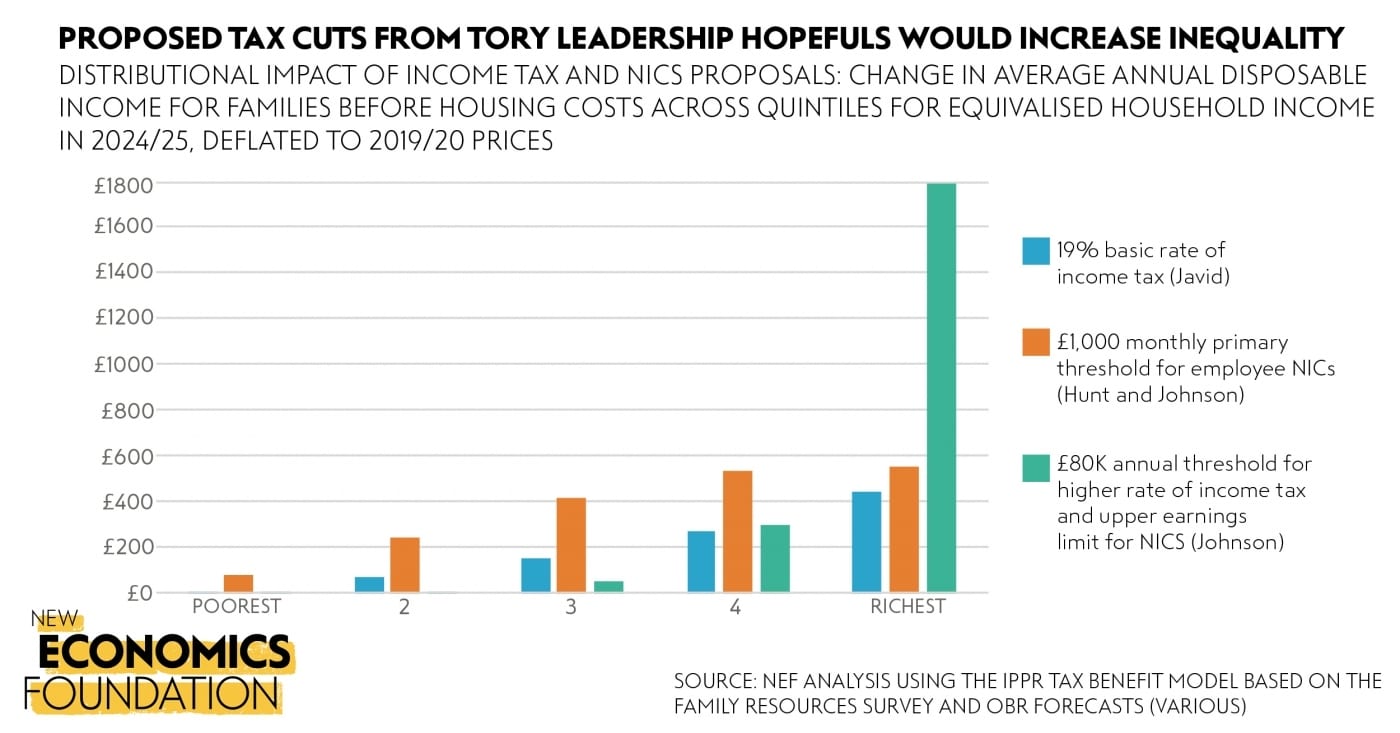

Three out of five candidates in the running to become the leader of the Conservative Party have committed to significant cuts to personal taxation that would benefit the UK’s richest 20% of families at least 7 times more than the poorest 20% during yesterday’s debate, according to new analysis from the New Economics Foundation (NEF) published today. With a new Prime Minister due to be selected in July, any proposed tax reforms could become government policy as early as the 2019 Autumn Budget.

Jeremy Hunt promised to abolish employee national insurance contributions (NICs) for the first £1000 of earnings each month. Boris Johnson also confirmed support for similar cuts to NICs and reaffirmed his ambition to lift the threshold for the higher rate of income tax to £80,000. Sajid Javid claimed he would lower taxes by cutting the basic rate of income tax below 20%.

New microsimulation modelling by NEF has shown that all proposals would increase inequality and poverty, while costing between at least £4.4 and £9.5bn every year

- Increasing the monthly threshold of NICs, supported by both Jeremy Hunt and Boris Johnson, would cost £8.2bn per year if the lower earnings limit were set at £1000 per month. The effect would be to increase disposable incomes by £560 for the richest 20% of families and £80 for the poorest 20%. As a result, the reform would push 50,000 families below the new poverty line.

- Cutting the basic rate of income tax, as proposed by Sajid Javid, would cost £4.4bn if lowered by just 1%. This would increase annual incomes for the richest families by £450 compared with just £10 for the poorest, and push 50,000 more families into poverty. If cut by as much as 5% (as proposed by previous leadership candidate Dominic Raab) the treasury would lose more than £22bn in revenue every year and 150,000 families would fall below the poverty line.

- Increasing the annual threshold for the higher rate of income tax and the upper earnings limit for NICS from £50,000 to £80,000, proposed by Boris Johnson, would cost £9.5bn per year. The richest households would on average see disposable incomes rise by £1,790 per year, with no rise at all for the poorest 20% of families.

The modelling results showed that proposed changes to NICs and the basic rate of income tax would increase inequality for two main reasons. First, those families with little or no taxable income, who make up the majority of the UK’s poorest households, by definition miss out on the benefits altogether. Second, families with two or more people in receipt of taxable income – which tend to be higher up the income distribution on average – will receive at least double the benefits from the proposed tax cuts compared to families with just one person in work. The proposed increase to the higher rate threshold would only cut taxes for the richest 15% of taxpayers, with the largest gains going to those earning more than £80,000 per year (top 5%).

Figure 1 – Distributional effects of income tax and NICs proposals

Change in disposable family income before housing costs across deciles for equivalised household income in 2024/25, deflated to 2019/20 prices

Source: NEF analysis using the IPPR tax benefit model based on the Family Resources Survey and OBR forecasts (various)

Alfie Stirling, Head of Economics at the New Economics Foundation, said:

“It’s easy to forget that last night’s TV sound bites could become government policy in a matter of weeks. Committing to cut taxes may sit well with Conservative party members. But look beneath the bonnet and it is clear that all the proposals being put forward would serve to benefit the very richest more than anyone else.

“Whatever the outcome of Brexit, any of these reforms would leave Britain a more unequal society with higher levels of poverty for both children and adults. For everyone feeling the impact of increased NHS waiting times, overcrowded school classes and unaffordable social care, these tax cuts will come as a double blow: foregoing billions of pounds in revenues that could otherwise have been used to boost public services.”

Notes

The New Economics Foundation is a charitable thinktank. We are wholly independent of political parties and committed to being transparent about how we are funded.

In 2019, NEF became a research partner on the IPPR tax and benefit model. The model uses micro data from the 2016/17 Family Resources Survey (FRS) – a dedicated survey for tax and benefit microsimulation modelling commissioned by the Department for Work and Pensions – and combines this with outturn and forecast estimates for key economic aggregates (such as interest rates and average earnings) from the Office for National Statistics and Office for Budget Responsibility, respectively. The model works by simulating new scenarios for the UK labour market, earned and unearned income and tax and social security. The model estimates the impacts of policy change, including a breakdown of fiscal effects (changes to government expenditure and receipts), distributional impacts across family incomes and the implications for various measures of inequality and poverty. The model is capable of accurately estimating interactions and co-dependencies within different elements of tax and means-tested benefits, but it does not attempt to estimate behavioural effects.

Technical notes:

- All modelling was simulated for the 2024/25 financial year with cash values deflated to 2019/20 prices using the ONS GDP deflator. Quintile groups for families were estimated on the basis of disposable family income, equivalised for the number of adults and children in a family using the OECD equivalisation scale.

- Poverty is defined in terms of people living in families with equivalised disposable income after housing costs below 60% of the UK median. In all cases the poverty threshold has been recalculated to incorporate the effects of policy changes on the income distribution. Poverty results have been run on a three-year sample of the FRS to improve sample size and results have been rounded to the nearest 50,000

- Estimated impacts on tax receipts are net of any savings to government from means tested benefits and rounded to the nearest £100 million.

- The cash impact on families is also net of any change in entitlement to means tested benefits and pertains to annual disposable household income after housing costs, rounded to the nearest £10.

- Michael Gove and Rory Steward have not yet committed to detailed plans to reform personal taxation

Table 1 – summary of results

All results modelled in the 2024/25 financial year with cash values deflated to 2019/20 prices using the ONS GDP deflato

Source: NEF analysis using the IPPR tax benefit model based on the Family Resources Survey and OBR forecasts (various)

* Net effect on annual fiscal balance taking into account changes in means tested benefits as a result of higher post-tax income, rounded to the nearest £100m, 2019/20 prices

** Average change in disposable family income before housing costs across within respective quintiles for equivalised household income, rounded to the nearest £10, 2019/20 prices

*** Change in poverty count, defined as families below 60% of equivalised household income after housing costs, poverty threshold recalculated after the effects of policy change

Image: Jordhan Madec, Unsplash

Topics Inequality