Greening finance to build back better

A UK roadmap ahead of COP26

23 June 2021

Co-published with Positive Money.

With the UK set to host the 26th UN Climate Change Conference of the Parties (COP26), there is an unprecedented opportunity to shape the green finance agenda and support a ‘build back better’ recovery. Chancellor Rishi Sunak has pledged to make the UK a world leader in green finance. The recent decision to green the Bank of England’s mandate is a significant stride towards realising such an ambitious goal.

Indeed, this reform could not have come at a better time. Without a much more active approach by the Bank of England to re-align financial flows towards net zero (enabled by its new remit), existing policy measures will not be enough to align finance with climate targets in the timeframe required for transformative action. Nor will they help to boost the incomes, jobs, or economic prospects of the local communities to deliver the government’s levelling-up agenda and the wider build back better programme.

Ahead of hosting the COP26 summit, and in the light of the Bank of England’s new green mandate, this report lays out a bolder policy roadmap that reshapes UK finance and harnesses its power to genuinely build back better by supporting a green and socially just recovery.

Key messages:

- Policy attention is overwhelmingly focused on protecting the financial system from the risks posed by climate change, with scant attention given to protecting the climate from the risks created by finance.

- The financial system is currently misaligned with the goals of a green transition. Relying solely on market-led approaches risks both failing to manage material risks to the financial system and failing to sufficiently‘green’ financial flows in the timeframe remaining for transformative action.

- With only 2% – 5% of bank lending ahead of the pandemic going to small and medium enterprises (SMEs) – from which 60% of private-sector jobs in the UK come from — the set-up of the current financial system is not geared towards providing the vital patient strategic finance needed to support jobs, businesses, and local communities as part of a green recovery .

- With a new green mandate, the Bank of England has no excuse not to take action to stimulate green financial flows and regulate unsustainable private financial flows. But it cannot go at it alone; it will need to closely collaborate with public bodies and elected officials.

Key policy recommendations

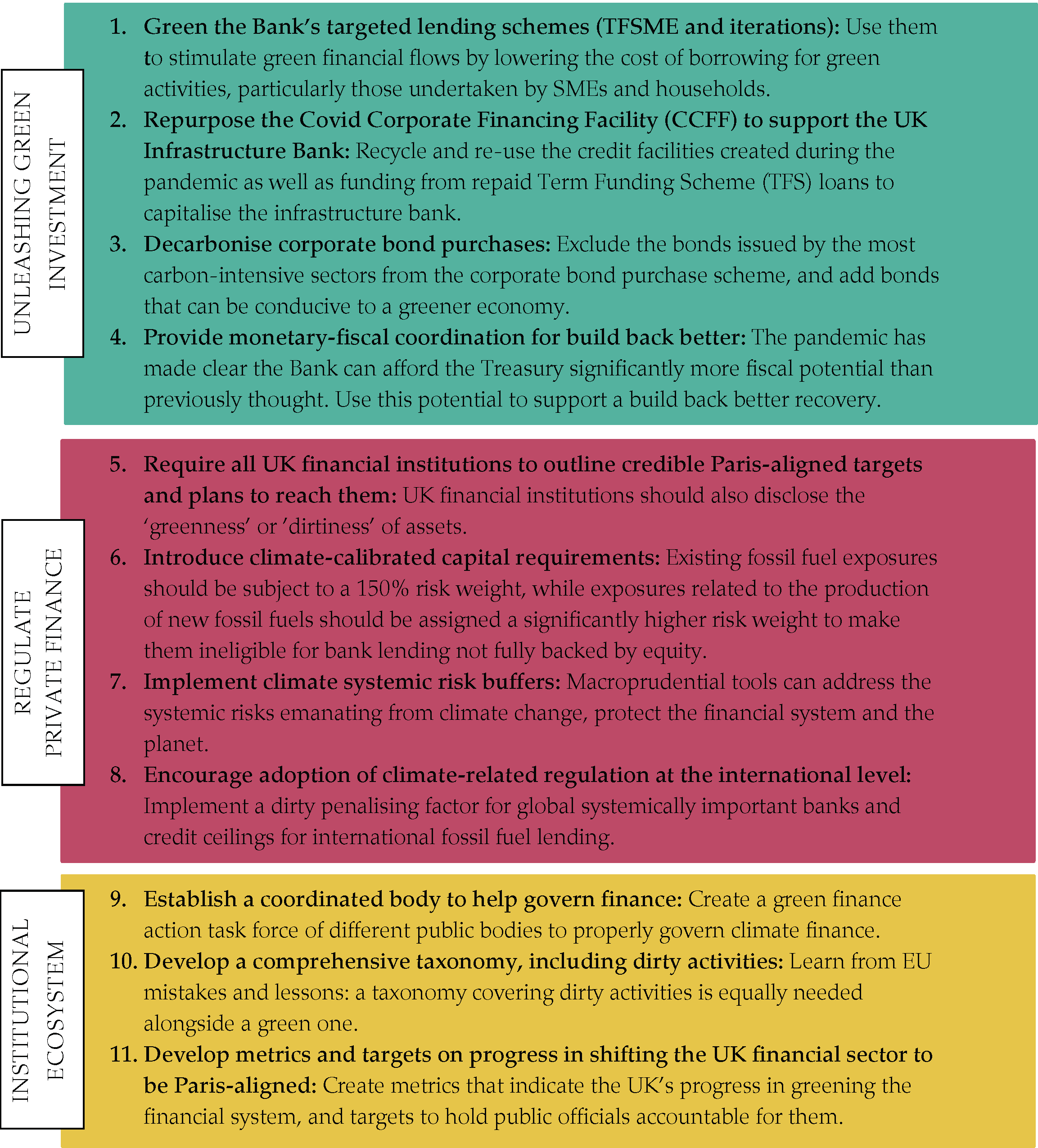

Unleash green investment

The Bank of England, in coordination with the Treasury, needs to actively support a green build back better recovery by using the policy tools at its disposal. This should involve supporting green investment in the real economy by adjusting its lending schemes to provide cheaper credit to commercial banks, conditional on banks expanding their lending for sustainable projects, particularly SMEs. The Bank of England should also provide additional capital to the new UK Investment Bank by redirecting money it receives in repaid loans from financing facilities launched in response to the pandemic.

Regulate private finance

UK financial regulators need to ensure that private finance supports, rather than obstructs, the government’s climate and levelling-up goals. The Bank of England and the Treasury should mandate that all UK financial institutions outline credible transition plans aligned with the Paris Agreement. They should introduce measures that require private financial institutions to fully account for climate-related financial risks, and push for Paris-aligned regulation of the financial system at the international level.

Reform the institutional ecosystem

The UK government needs to put in place the necessary institutional framework to deliver a green recovery and a just transition to net zero. This should involve establishing a coordinating task force of different public bodies to govern climate finance, as well as developing metrics and real-world targets to measure progress in shifting Britain’s financial sector towards Paris alignment.

Table 1. Key policy recommendations

Image: istock

Topics Banking & finance Climate change