2.2 million more people will need to make sacrifices on essentials like putting food on the table or replacing clothes this year

New analysis by the New Economics Foundation shows that families newly pushed into crisis are on middle incomes, with average earnings from work of £33,000 a year

05 May 2022

An additional 2.2 million people (900,000 households) will be making sacrifices on essentials like household bills or a trip to the dentist this year according to new analysis by the New Economics Foundation (NEF). Families newly pushed into crisis are on middle incomes, with average earnings from work of £33,000 before tax.

The research uses the Minimum Income Standard (MIS), which is the UK’s leading approach to measuring living standards based on need and is used to calculate the‘real’ Living Wage paid by companies like Ikea and KPMG, and football clubs like West Ham, Liverpool, and Everton.

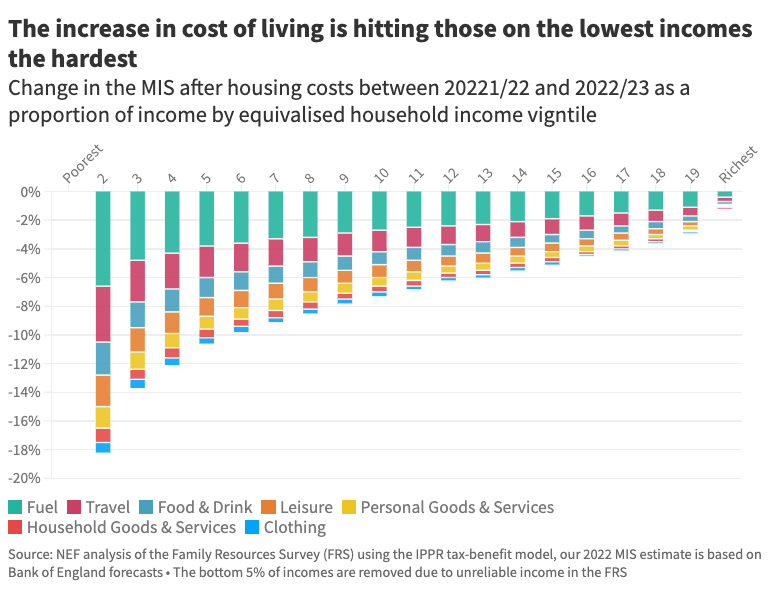

NEF found that overall, 23.5 million people will be unable to afford the cost of living this year. The modelling shows that the average cost of essentials for UK families (measured by the MIS) is rising by £2,300 or 6% of average household income compared to last year. But this rise won’t be felt equally across all households:

- The rise in costs for the poorest half of people is nine times larger than for the richest 5% as a proportion of income, and for families in the middle of the income distribution the rise in costs is six times larger.

- White households are seeing an average increase in costs of essentials of £2,200 (5% of their income) while the increase for black, Asian and minority ethnic (BAME) households is £2,900 (8% of their income). This means on average BAME households are 1.6 times more affected by the cost of living than their white counterparts.

- Single adult female households will see costs increasing by £1,400 (6% of income) on average compared to £1,110 (4% of income) for single adult male households. This means women are 1.5 times more affected than their male counterparts on average.

NEF argues that the policy response to the cost-of-living crisis is inadequate and poorly targeted. The analysis shows that the fuel duty cut and increase to the national insurance threshold announced in the spring statement leaves the richest 5% of families £600 better of each year, whereas the poorest half of households will only see an average increase of £300.

NEF is calling for the creation of a new social security system, or‘Living Income’, to set an‘income floor’ based on the MIS, below which no one can fall whether they are in or out of work. The research sets out four steps towards a Living Income:

- Auto-enrolling everyone in the UK on the universal credit system so that new payments start to be processed automatically as soon as anyone becomes eligible. This would ensure the 1.3 million people missing out on payments worth an average of £7,300 a year would receive the support they are entitled to.

- Restoring the £20 uplift for universal credit and extending to all other means-tested benefits to ensure the poorest are at least made no worse off on average by recent price rises.

- Investing a further £7 – 8bn in universal credit to lift families closer to the MIS.

- Uprating benefits by the latest level of inflation to ensure incomes rise alongside prices.

Sam Tims, Economist at the New Economics Foundation, said:

“The cost-of-living crisis will deepen inequality in Britain and yet no political party is talking seriously about addressing the enormity of this challenge by fixing our broken social safety net.

The worsening crisis makes clear that we urgently need a bold new way of doing income support to ensure households do not fall into deeper levels of destitution. Poverty limits people’s freedom, restricts education and health outcomes and reinforces the imbalance in our economy.”

Contact

Becky Malone, becky.malone@neweconomics.org, 07925950654

Notes to editors

The analysis is available here.

The New Economics Foundation is a charitable think tank. We are wholly independent of political parties and committed to being transparent about how we are funded.

To measure the cost of living we use the Minimum Income Standard (MIS) as calculated by Loughborough University’s Centre for Research in Social Policy. Household budgets for different family types are calculated based on what the public thinks is needed for an acceptable standard of living. We then compare these budgets to household income calculated by the IPPR’s tax and benefit model using data from the Family Resources Survey. This comparison provides an accurate how many people will be unable to afford the cost of living.

Topics Social security Inequality