New EU fiscal rules jeopardise investment needed to combat climate crisis

Limits will hit poor countries the hardest

31 August 2023

A desperately needed reform of the EU’s fiscal rules is finally underway. However, the proposed rules put forward by the Commission are irresponsible – they jeopardise the public investments needed to combat climate change. The inclusion of uniform debt and deficit rules, advocated by Germany and other frugal countries, would instil the same failed economic principles that have made Europe poorer for over a decade. Moreover, these rules would lead to some countries having to reimplement the failed austerity of the past. But this is unnecessary: at least €135bn per year could be spent on green investment by the EU’s most indebted countries with debt still falling by the 2030s.

To effectively address the climate crisis, early investments that rapidly cut emissions are essential. Unfortunately, the proposed fiscal rules prevent the fiscal stimulus that would reduce emissions. This is particularly counterproductive, as green spending has an outsized multiplier effect when compared to other public investments.

The EU’s proposed fiscal rules will also lead to greater economic divergence between countries. Wealthier countries, which have a greater capacity to borrow within fiscal rules, will be able to leverage green public investments to address climate challenges and effectively stimulate economic growth. Less wealthy nations will be more restricted.

The EU’s fiscal rules are built upon the so-called Maastricht criteria require governments to maintain budget deficits and public debt below 3% and 60% of GDP, respectively. The Commission’s proposal for new fiscal rules however introduces a new approach to categorise countries based using a Debt Sustainability Analysis (DSA), dividing them into high‑, medium‑, and low-risk groups.

High and medium-risk countries are required to reduce their debt and/or deficits, while low-risk countries are expected to maintain debt levels below 60% and deficits below 3%. This country-specific approach, which suggests negotiated adjustments with governments, replaces the previous uniform reductions mandated – the 1/20th rule, which required a 0.5% reduction in debt for excess debt above the 60% debt-to-GDP limit.

The Debt Sustainability Analysis is based on a complex model that uses a range of indicators and uncertain assumptions including growth rates, interest rates, inflation, and 10-year debt forecasts. However, the impacts that spending cuts could have on growth and debt trajectories are omitted, and the costs of austerity on social outcomes and the environment are ignored.

In addition to the 3% deficit limit remaining a hard limit, the Commission’s proposed rules include other one-size-fits-all rules. These benchmarks entail reducing the deficit by 0.5 percentage points of GDP per year after breaching the 3% limit, decreasing debt within a four-to-seven-year timeframe, and keeping expenditure below potential GDP growth. Some countries, led by Germany’s Finance Minister Christian Lindner, continue to advocate for additional uniform rules to accelerate debt reductions.

Our analysis shows the risks associated with the proposed fiscal rules. Specifically:

- 3% deficit hard limit: While the 60% debt-to-GDP limit serves as a target, the 3% deficit limit is a hard limit, which means only four countries would be able to invest sufficiently to limit global warming to 1.5°C.

- Somewhat arbitrary (leaked) Debt Sustainability Analysis outcomes: We find that 10 out of the 15 member states with debt-to-GDP ratios exceeding 60% would experience faster debt reduction compared to the current 1/20th rule.

- Numerical benchmark requires member states above the 3% deficit limit to reduce deficit spending by a minimum of 0.5% of GDP annually: But this can be counterproductive in reducing debt-to-GDP.

- Requirements for growth in net expenditure to be lower than GDP growth: This ignores that a 1% green stimulus, irrespective of the current deficit position, can generate growth and reduce debt-to-GDP in the medium term due to the outsized green multiplier.

- Requirement for a reduction in debt-to-GDP within the initial four to seven-year period: We argue that this contradicts scientific conclusions on how we act on climate, which requires us to make early investments to cut emissions rapidly.

We expand on each of these points below.

1. 3% deficit hard limit

Commission proposed rule: Relaxing the 60% debt-to-GDP ratio, but 3% deficit limit remains a hard limit

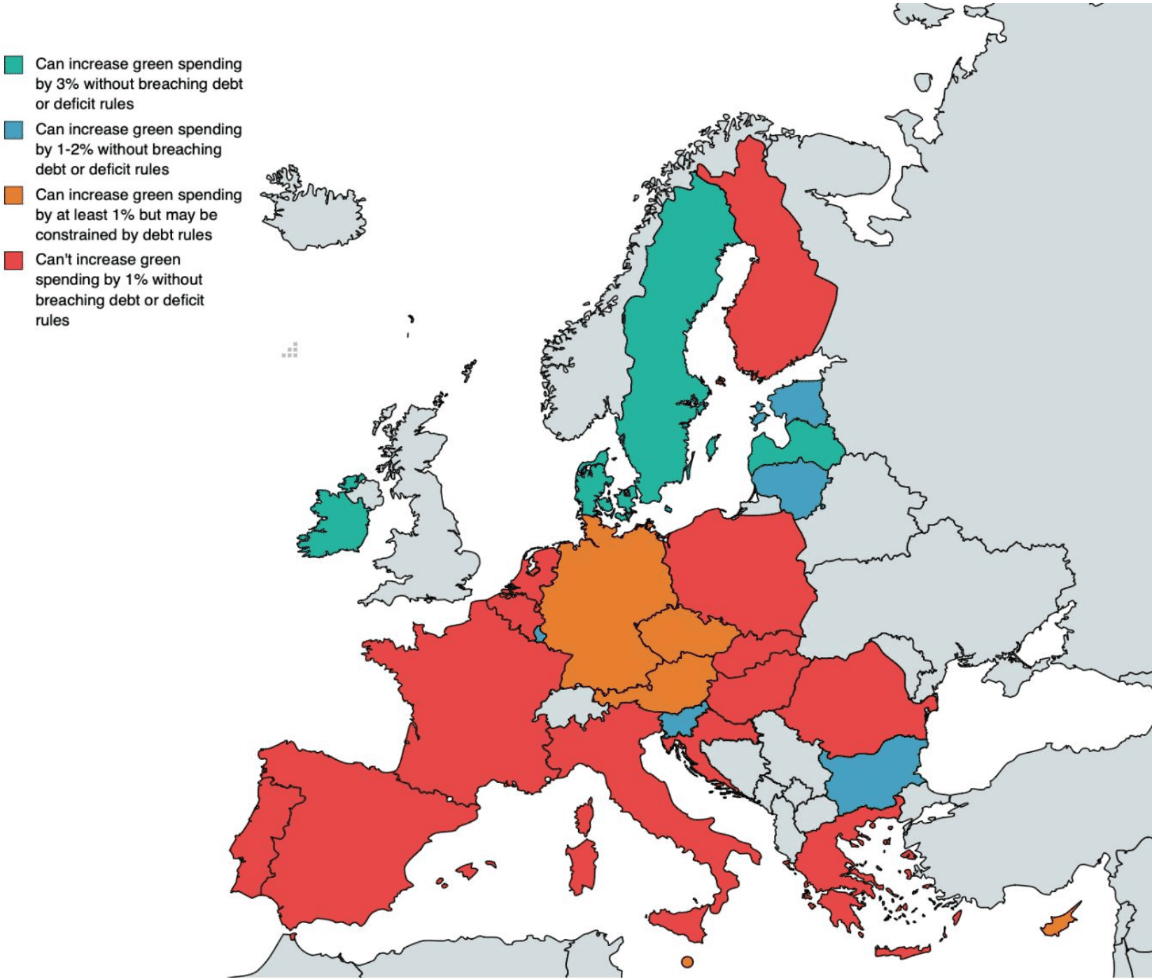

In a recent NEF report, we showed that fiscal rules limit all but four European countries from investing enough to meet their Paris climate commitments and limit global heating to 1.5C (see figure 1). In order to meet the EU’s more limited climate targets of cutting emissions by 55% by 2030, proposed borrowing rules would leave 13 countries, representing half of the bloc’s GDP, unable to invest enough.

Deficit rules stand in the way of European climate goals. The strict 3% deficit limit makes it harder for the EU to meet its own climate targets or go beyond them to meet the 1.5C objective, set out in the Paris Climate Agreement. This hard deficit limit stops governments from investing enough to limit the damaging effects of climate change. Moreover, fiscal rules are likely to drive economic divergence between richer and poorer/more fiscally constrained countries within the EU, as wealthier EU countries will be able to spend much more than others.

Figure 1: Only four EU countries can meet the 3% green spending increase required to meet the high emission reduction scenario.

Assessment of countries’ ability to meet different scenarios of increased spending at 1%, 2%, and 3% of EU GDP

Note: NEF analysis

2. Debt Sustainability Analysis outcomes

Commission proposed rule: Debt Sustainability Analysis will be used to propose and negotiate debt adjustment paths with member states.

The (leaked) Debt Sustainability Analysis (DSA) simulation proposes somewhat arbitrary debt adjustments across the EU. Figure 2 below illustrates the initial debt-to-GDP ratios against the implied adjustment needed according to the Commission’s DSA simulation. In the graph below, the old rule being replaced by the new framework – the 1/20th rule – is plotted as a line. There is a division between countries with lower debt-to-GDP ratios (under 100%) and those with higher ratios. Being under the 1/20th line in this scenario implies a larger adjustment is required than implied by the debt-to-GDP ratio alone, while being above it means a smaller one is required. Therefore, while countries like Italy require smaller debt adjustments, nations like Portugal or Cyprus will require a greater adjustment under the DSA compared to the 1/20th rule.

Figure 2: Adjustments under new fiscal rules could be stricter than older rules for poorer countries.

The DSA’s opacity makes it difficult to understand country-specific adjustment paths. For instance, Austria and Cyprus start on very similar levels of debt yet are assigned very different reduction targets: 16.6% debt-to-GDP reduction for Austria and 46.2% for Cyprus. Similarly, Belgium, Spain and Italy all need to achieve approximately 20% reductions, despite different initial levels of debt. This highlights the need to make the calculations and assumptions behind the DSA transparent so they can be adequately assessed.

Historical data and past austerity might explain differences. One possible factor driving the difference between countries is inclusion of historical fiscal adjustments in the DSA. Countries that made large fiscal adjustments in the past are assumed to be more capable of making similar adjustments in the future. However, this reinforces the negative and counterproductive impact that austerity had on public services, economic growth and, consequently, debt-to-GDP ratios.

The graph demonstrates that countries like Greece, Portugal and Cyprus, which experienced significant deficit fluctuations due to imposed austerity, face no difference or even stricter enforcement of fiscal rules compared to the 1/20th rule. But countries like Belgium or France, which have largely avoided enforcement of fiscal rules over time, see the rules relaxed under DSA. Instead, the risk classification should be rather based on a broader set of indicators, and further development of the DSA should take place in an inclusive and open process.

The German Finance Minister Lindner is now pushing for an additional one-size-fits-all debt reduction target of 0.5% debt-to-GDP reduction for all countries above the 60% debt-to-GDP limit and 1% for highly indebted countries. This rule would require less reductions compared to the 1/20th rule, but as it would be applied from day one, would not allow early investments that would grow GDP and so allow countries to reduce their debt-to-GDP ratios through growth. This also runs counter to the logic of the Commission proposal to allow countries four to seven years to reduce their debt by increasing investments. It would have a significant impact on those countries that request an extension, in particular those classed as high-debt risk.

3. States above 3% deficit limit must reduce deficit spending by 0.5% GDP every year

Commission proposed rule: The Commission’s proposal includes a one-size-fits-all rule that would mean countries would have to reduce their deficits by a minimum of 0.5 percentage points of GDP per year when their deficits are above 3%.

This rule implies rapid cuts. In 2024, this rule would require €45bn worth of cuts in the next year across the 14 affected countries. This would imply austerity measures at a time when the EU needs to be rapidly scaling up public investments in climate and nature preservation, as well as spending in areas such as health, education, and social sectors.

Deficit spending can reduce the debt-to-GDP by boosting GDP growth. Higher GDP growth enables a decrease in the debt-to-GDP ratio even when a country is running a deficit. By using a simple model where debt levels increase by the annual deficit, we can observe how various levels of growth correspond to different deficits required to achieve specific adjustments in debt-to-GDP ratios. Here, we examine adjustments from 100% to 80% and from 80% to 60% over a 14-year period.

Figure 3: Higher growth means debt reductions can be achieved even with high deficits.

Surpluses are not necessary to achieve debt reductions under normal growth rates, as shown by the graph above. Growth rates of over 2% mean that it is possible for the debt burden to fall even when the government is running a deficit. In fact, for high levels of growth the debt-GDP ratio can fall even when the 3% deficit limit is breached. The converse is true that in a low/negative growth scenario then surpluses may be needed. Therefore, having deficit limits that, by design, do not account for the impact of growth on total debt levels will lead to counterproductive decisions with lower growth and more debt.

Government deficits/surpluses aren’t independent from growth. If governments use deficit spending to invest in climate or public services, this can lead to greater growth. Whereas if governments make cuts to welfare systems, schools and hospitals, this can lead to lower growth. These cuts can, perversely, lead to higher debt burdens as GDP growth is lowered. Such austerity is self-defeating There have been numerous studies which have shown that these fiscal rules have reduced economic growth.

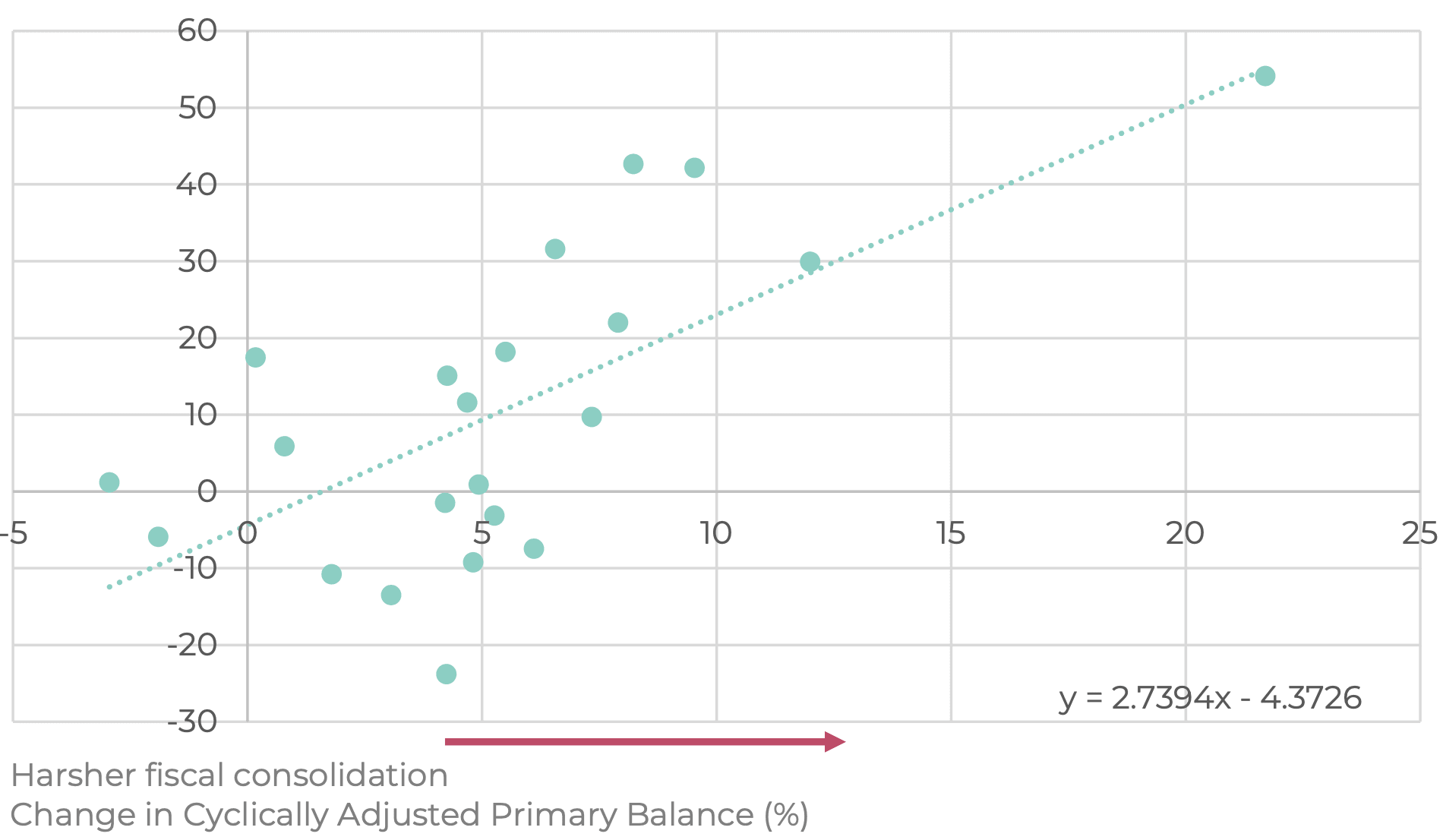

On average, fiscal consolidation does not reduce debt-to-GDP and instead increases total debt, as shown by recent IMF analysis. This has also been acknowledged by the EU Commission and is its justification for the country-specific approach. Our own analysis illustrates this: countries that made larger adjustments saw their debt-to-GDP grow by more, not less.

Figure 4: The countries that cut their budgets the saw the biggest increases in their debt-to-GDP ratios in major European economies.

Change in cyclically adjusted primary balance and change in the debt-to-GDP ratio (%) for European economies, 2009 – 2019.

Source: Author’s own calculations based on IMF (2022)

Uniform deficit reduction rules can increase debt burdens. Taken together, requiring one-size-fits-all deficit adjustments can be particularly problematic and in conflict with debt sustainability due to the negative effects fiscal cuts can have on growth and debt. Taking this into consideration implies that requiring 0.5% adjustments can create a vicious cycle where increasingly stringent public spending cuts are needed to maintain falling debt levels. Consequently, the rule to reduce deficit by 0.5% a year over the 3% deficit limit introduces an additional constraint on governments, forcing them to make difficult trade-offs between maintaining current levels of public service provision, increasing taxation, and increasing green spending to address worsening climate breakdown.

4. Net expenditure must be lower than GDP growth

Commission proposed rule: A government’s net expenditure should not exceed its potential GDP growth.

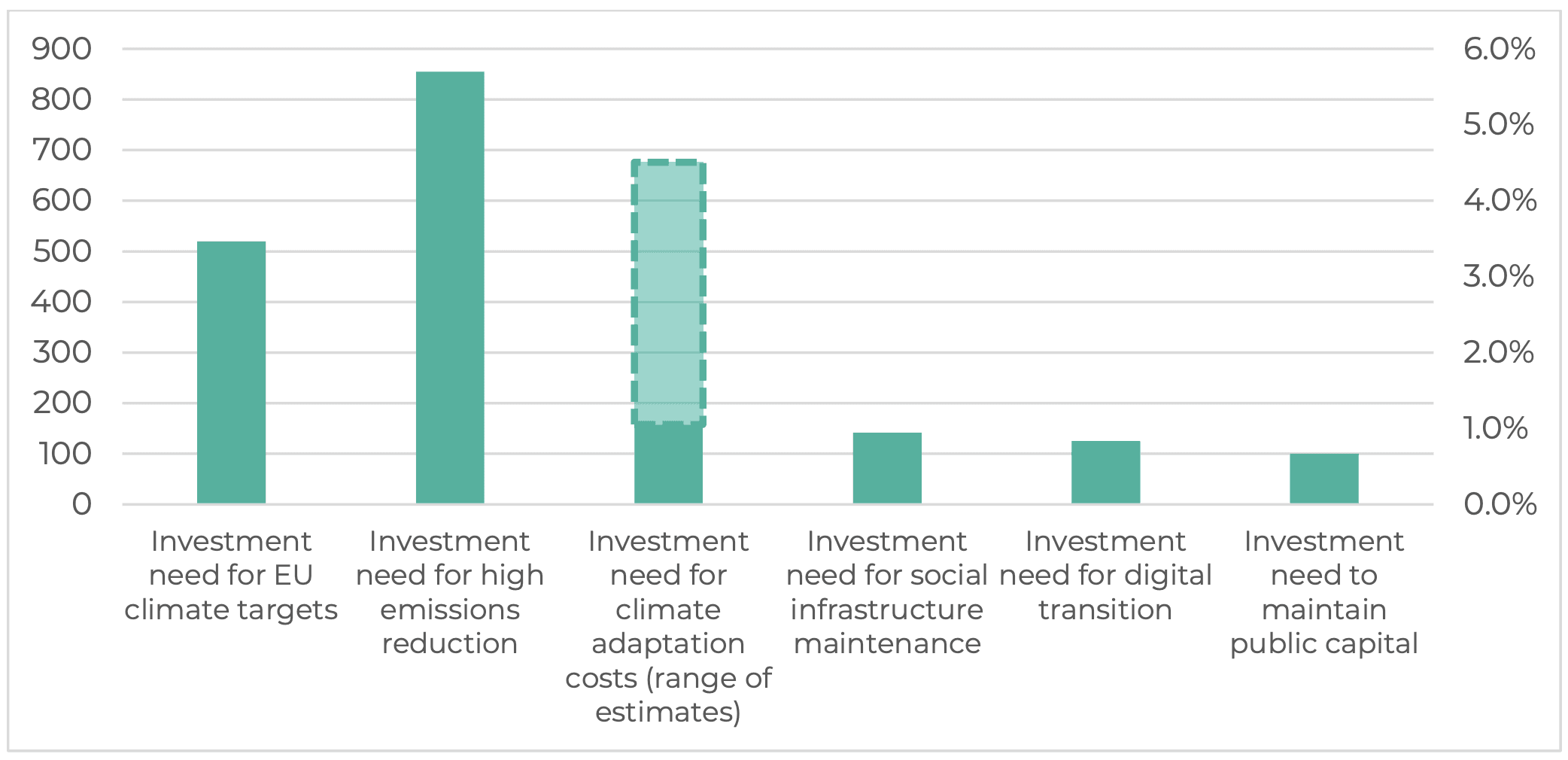

Green spending to tackle ecological crisis is needed (see figure 5) and is likely to stimulate growth. This rule therefore ignores the role that public investment has in creating and shaping the market and stimulating growth, as green investments have an outsized multiplier effect.

Figure 5: Multiple large climate and social total investment needs exist in the EU.

Visualisation of different estimated total investment needs, range estimates indicated by translucent bars, billions of euro (left axis), % of 2023 EU GDP (right axis)

Source: Investment gaps taken from the literature for climate, social, digital, and infrastructure spending referenced in the text including European Commission; Wildauer, Leitch & Kapeller; and Cerniglia & Saraceno.

Fiscal stimulus leads to falling debt ratios for a broad range of multiplier estimates. Our analysis (see figures 6 and 7) shows the impact of running a deficit at 1% of GDP, using a range of interest rate projections and conservative assumptions regarding fiscal multipliers impact on long-term growth. (For example, multiplier effects are modelled such that stimulus has zero effect on potential growth in the long term.) Concretely, we find that at least €135bn per year could be spent on green investment by the EU’s most indebted countries with debt still falling by the 2030s. These are likely to be underestimates of the fall in debt-to-GDP ratios due to the potential transformative effects of government investment on economic growth. Furthermore, even in adverse interest conditions, where stimulus is more expensive and adds more to the debt, we see debt declining for most countries.

Stronger fiscal multiplier effects can reduce debt-to-GDP, even if we assume a low multiplier for green investments and an adverse interest environment. This suggests that stimulus that is not necessarily an ‘investment’ with returns to growth can still be justified, especially when it is necessary to achieve environmental and social goals. Regardless, the reported multipliers for social and environmental spending are often higher than general government spending on average.

Figure 6: At least €135bn per year could be invested into green transition by the EU’s most indebted countries with debt ratios still declining.

Figure 7: At least €135bn per year could be invested into green transition by the EU’s most indebted countries with debt ratios still declining

Higher debt-to-GDP ratios than Commission proposals are not a cause for concern. First, debt limits themselves are an arbitrary indicator of fiscal risks, especially if they are implicitly scenarios that do not allow for unlocking more stimulus spending to combat climate change or invest in social infrastructure. Second, the objective of the DSA is to push economies onto paths where debt is decreasing – as can be seen in the graph above, this is still the case even when the 1% stimulus is constant throughout the period. For some countries this does mean that the debt-to-GDP ratio rises temporarily but is the prudent course of action as this will help to prevent climate disaster.

Investing in climate policies through fiscal stimulus can reduce debt burdens. Overall, these results demonstrate that a declining debt-to-GDP ratio and increased green spending/fiscal stimulus are not in conflict with one another. Further, restricting spending now will lead to higher expenses in the future as climate impacts become more frequent and climate adaptation more expensive.

5. Debt-to-GDP must reduce in four to seven years

Commission proposed rule: Governments classified as high or medium debt risk will need to ensure that after a maximum of four to seven years their debt is on a ‘plausibly and continuously declining path’.

Under pressure, the final proposal included an additional restriction, that requires, firstly, a reduction in debt-to-GDP in this initial four-to-seven-year period, and secondly, that debt and deficit reductions should not back-loaded, meaning that the debt and deficit reduction must not be forecast to fall at the end of the 4 – 7 years.

This contradicts central scientific conclusions on how we act on climate, which require us to make early investments to cut emissions rapidly. Delaying these investments will be counterproductive. Climate adaption and mitigation costs rise the longer we wait.

As described above, the suggestion by the German government to require uniform debt reductions from day one, including in the first four to seven years, would further restrict the logic of reducing debt-to-GDP through public investments.

Conclusion

The proposed fiscal rules limit member states’ access to funds for crucial green investments, likely leading to less than necessary carbon cuts or significant cuts in other public expenditure to finance green investments. Strict adherence to these rules is likely to worsen economic disparities between member states and hinder collective climate objectives. Indeed, a repeat of counterproductive fiscal rules is likely to contribute to further economic divergence between the US and the EU, especially as the US is scaling up public investments in green industrial policies.

To address these issues, decision makers should reject numerical benchmarks on debt and deficit limitations. Instead, a flexible approach should be adopted, considering the specific needs and circumstances of member states. Shifting the emphasis from rigid targets to a comprehensive assessment framework with open-source data and transparent processes would foster adaptability and alignment with evolving challenges.

To create more fiscal space and address spending gaps, three strategies should be pursued:

- First, the climate crisis is existential for us, so green spending should be excluded from the 3% deficit limit.

- Second, the “do no significant harm” principle should apply to phase out harmful public investments.

- Third, the EU should establish an EU-level investment facility financed through new common borrowing. Such an EU-level investment fund should develop green industrial policies, public infrastructure, and resilience-enhancing investments and reforms.

Read about the Fiscal Matters coalition’s demands

Technical notes:

When we have referenced Commission DSA data we are using leaked documents supplied by Politico.

In the 1/20th rule and DSA adjustment comparison it is worth noting that DSA is both a recommendation and a forecast. Therefore, while the 1/20th rule only implies the adjustment needed, while above 60% the DSA adjustment will include any adjustment after this has been achieved. Regardless, our modelling showed that countries would make adjustments larger than required by the 1/20th rule in the period they are above 60%.

In our modelling of stimulus we assume that borrowing is taken out on ten-year bonds at par with coupon payments equivalent to the May 2023 data from the commission on secondary market yields on government bonds with maturities of close to 10 years per country. The high and mid-range multipliers are taken from this IMF paper with estimates on the impact of the European Structural Investment fund environmental spending and in general. The low multiplier is from the 2022 Debt Sustainability Monitor from the EU Commission.

Topics Macroeconomics Climate change