New polling finds that only 10% of people think there should be a cut to Universal Credit

New analysis by the New Economics Foundation shows that when the £20 Universal Credit uplift is cut some families will be left with just over half (54%) of the income they need to live

27 September 2021

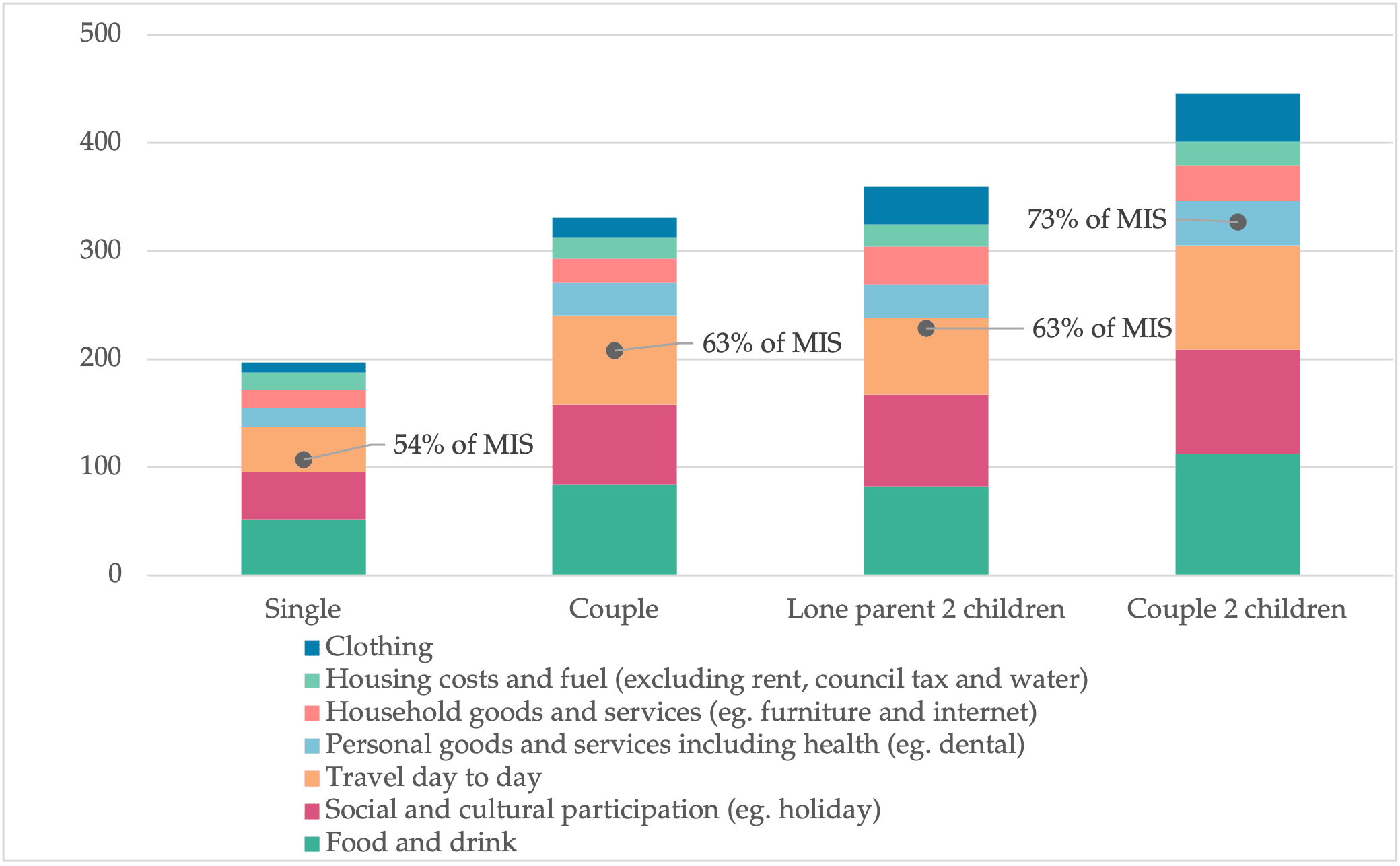

Only 10% of people think there should be a cut to Universal Credit, according to new polling carried out by Opinium for the New Economics Foundation (NEF). New analysis from NEF also shows that, even before the effects of energy price increases, the UC cut will leave many single adults with only 54% of the income they need to stay afloat (based on the UK’s Minimum Income Standard), while many couples with two children will have just 63% of the income they need.

The Minimum Income Standard (MIS) is the UK’s only needs-based approach to measuring living standards and is used to calculate the ‘real’ Living Wage paid by companies like Ikea and KPMG, and football clubs like Chelsea, Liverpool and Everton.

Over the last decade, £14 billion has been cut from the social security system – the £20 uplift, which cost around £6bn, only replaced half of this cut. Recent NEF modelling showed that when the uplift is removed, 21.4 million people, including 7 million children, will live in households that do not have the amount they need to afford all the basics.

The new modelling from NEF looks at how we could build a stronger safety net in the UK. The modelling looks at the effects of the £20 uplift, plus four other options to reforms to UC, including changes to the taper rate, all costing around the same as the £20 uplift. The effects of all five scenarios were then compared to UC without the uplift and modelled in 2026/27 when UC is expected to be fully rolled out. For the same cost as the £20 uplift to UC, which costs £7.5 billion by the time UC is fully rolled out in 2026/27, the Treasury could do any one of the follow options:

- Provide a £27 uplift to the amount of support a household receives for each child

- Remove the caps on support which limit the amount households can receive (the benefit cap and two-child limit), and providing a £12 per week uplift to the main adult element of support

- Lower the taper rate at which benefits are withdrawn for every £1 of earnings, from 63% to 50%

- Expand work allowances (the threshold beyond which the taper rate takes effect) to all claimants, and increasing the value of the work allowance for those who already achieve it by an hour at minimum wage

The analysis shows that investing in children will lift more people out of poverty for the same level of investment. Options to increase the child elements of UC, or else combining a smaller increase in the adult element with the removal of the two-child limit and the benefit cap, would each lift more than 900,000 people out of poverty respectively, whereas the maintaining the £20 uplift or investing more in taper rates and work allowances would lift around 600,000 out of poverty.

As well as different headline results, the analysis also shows that different options would also better support different types of families. The £20 uplift is particularly effective for non-working families without children, raising their incomes by more than £1,000 per year and moving them from a little over 50% of the Minimum Income Standard to around 60% of the MIS.

Boosting child elements increases disposable incomes for families with children on average by around £2,500 per year (moving a working couple with children from 78% of the MIS to 87%) and cutting the taper rate boosts incomes for working families by around £700 to £1,700 per year (moving a working couple without children from 72% of the MIS to 79%).

Based on these findings, the report recommends maintaining the £20 uplift while also introducing a mixed package on top that supports different family types, including removing the benefit cap and two-child limit, cutting the taper rate to 60% and introducing new work allowances for second earners. The package would lift most families to above 75% of the MIS and take 1.7 million people out of poverty.

Including the £20 uplift, the reforms would cost around £16 billion in total by 2026/27. The report sets out how this could be funded through reforms to capital gains tax, changes to tax relief on pension contributions and more progressive national insurance contributions.

Sarah Arnold, Senior Economist at the New Economics Foundation, said:

“The UK is in the midst of a cost-of-living crisis, and it is due to sharpen significantly for those on the lowest incomes over the next few months. Millions are set to be hit by a triple whammy of price increases for food and energy bills, welfare cuts and tax rises — all at the same time. Most worryingly for the five million families on Universal Credit, their support will be cut by up to £1,040 a year from next month.

“The UK safety net is already one of the weakest both among advanced economies and in the UK’s own post-war history. Yet this is about to be compounded by the largest overnight cut to welfare in 70 years, hitting families disproportionately in the North East, West Midlands, and Yorkshire and the Humber. It makes a mockery of the government’s intention to ‘level up’.

“The widespread deprivation that will result is devastating for the health and wellbeing of those affected. And there will be significant wider social and economic implications. The cut risks jeopardising any economic recovery from the COVID-related downturn, by cutting the incomes of those most likely to spend money to keep the economy moving.”

Contact

Sofie Jenkinson, sofie.jenkinson@neweconomics.org, 07981023031

Notes to editors

The full analysis will be available at 00.01 Monday 27th September at: https://neweconomics.org/2021/09/beyond-the-20-uplift-options-for-reforming-uc

Opinium carried out a nationally representative survey of 2,001 UK adults between 22nd-23rd September 2021.

The poll asked respondents: “Universal Credit is currently set at £129.26 a week for a single parent with one child. Do you think this is…Too much and should be cut/About right and should be kept the same/Too low and should be increase/Don’t know?”

£129.26 is the base amount available in Universal Credit for a single parent over 25 with a child born after 2017. There were 2001 respondents, of which 197 thought the amount should be cut, 693 thought it was about right, 771 thought it was too low and 339 didn’t know.

The New Economics Foundation is a charitable think tank. We are wholly independent of political parties and committed to being transparent about how we are funded.

Cutting the £20 uplift will leave some households with just over half of the income they need

2021 MIS (excluding rent, council tax, and water) compared to the average net disposable income after housing costs for those below the MIS, for those on universal credit or the legacy benefits it is due to replace, for November 2021 when the £20 UC uplift is removed

Source: NEF analysis of JRF/CRSP MIS and Family Resources Survey using the IPPR tax benefit model

Those in poverty are defined as families below 60% of median household disposable income.

The minimum income standard differs from other approaches to measuring living standards because it is based on assessment of the goods and services households need to live and thrive in contemporary Britain. Other measures, such as the relative or absolute poverty measures used by the government are based on average incomes rather than need.

NEF’s previous analysis of the living standards crisis, which found 21.4 million people, including 7 million children, will live in households that do not have the amount they need to afford all the basics after the £20 uplift is cut can be found at https://neweconomics.org/2021/06/the-uks-living-standards-crisis

Topics Social security