Budget tax rises to be overshadowed by Bank of England bond sales and losses

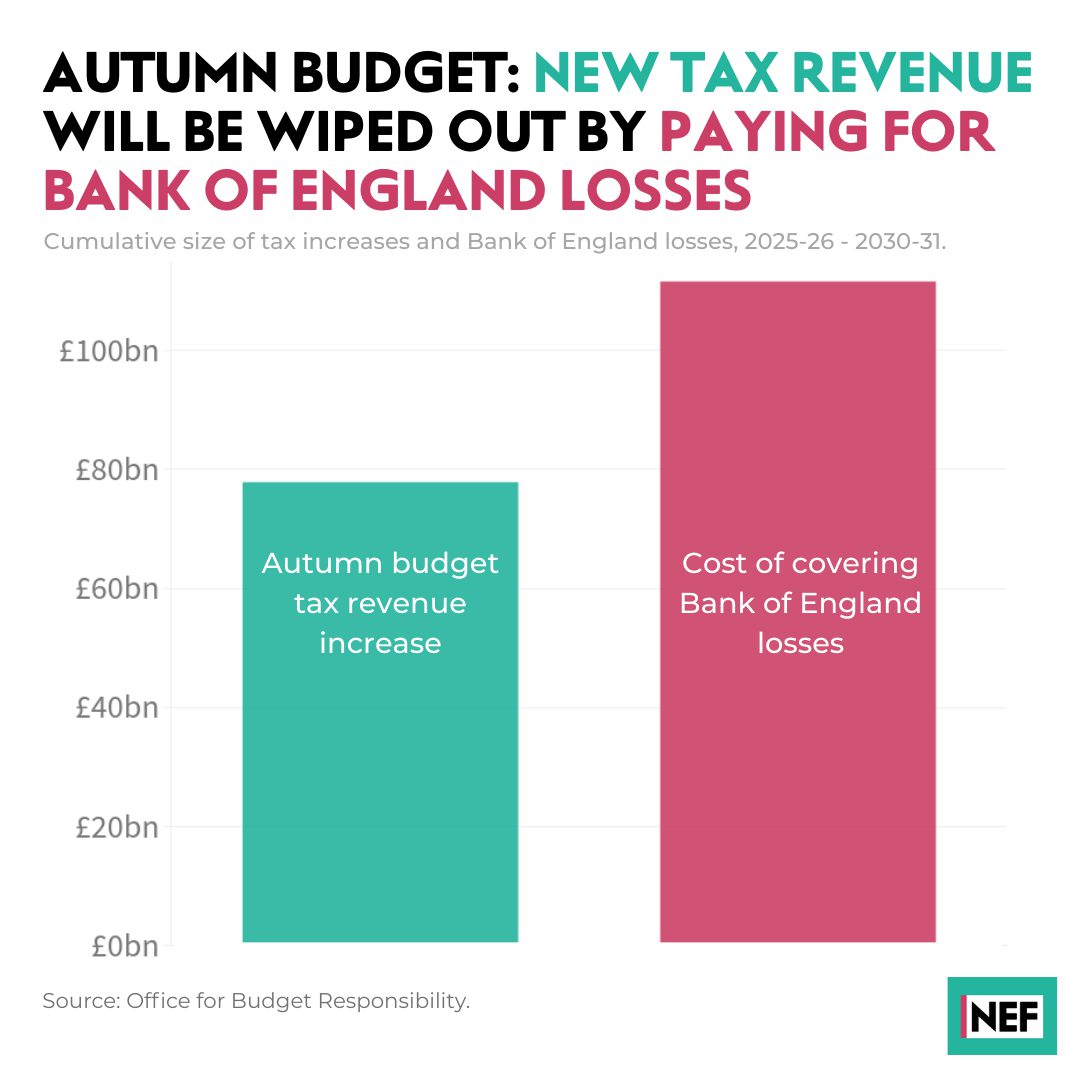

Bank of England to make cumulative losses of £112bn until 2030/31, wiping out the £78bn in tax rises raised in today’s budget

26 November 2025

The £78bn cumulative tax rises announced by the chancellor in today’s budget risk being wiped out by the £112bn worth of losses the Bank of England due to its active sales from quantitative tightening, the New Economics Foundation (NEF) has warned.

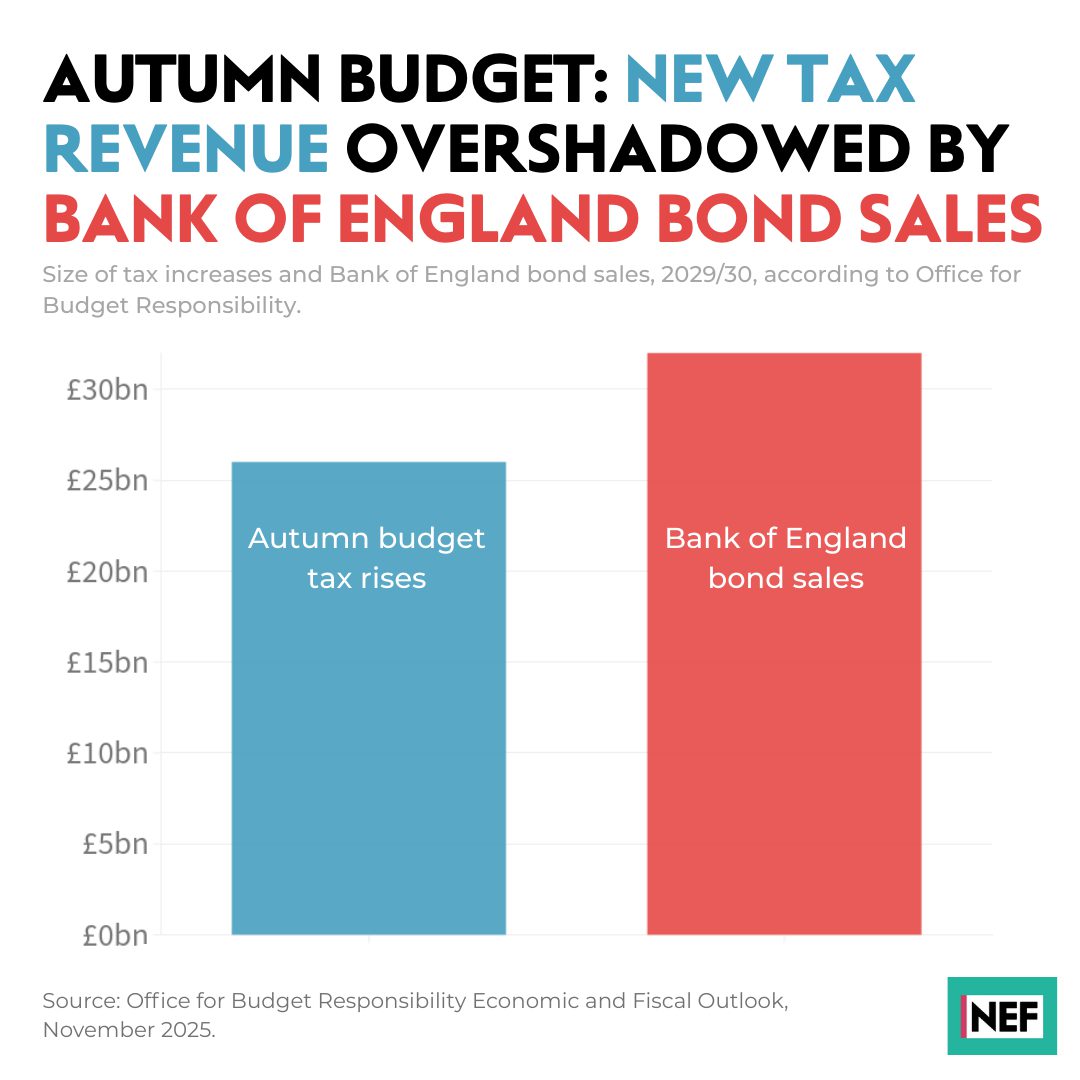

The Office for Budget Responsibility (OBR) assumes the Bank will be making £32bn worth of bond sales per year. This will be adding extra pressure on bond markets and overshadows the £26bn revenue the government just announced to raise in 2029/30 to try placating bond markets. Current Bank of England estimates suggest its sales have added up to 0.25 percentage points to government borrowing costs.

Slowing quantitative tightening, having the Bank of England absorb its own losses on its balance sheet and reducing the amount of interest paid out on reserves all offer ways for the government to recoup these losses and invest in public services and infrastructure.

Dominic Caddick, economist at NEF, said:

“It was necessary for the government to raise taxes at this budget, but more of this should have gone to increased spending on our public services not just to pad out our broken fiscal framework.

“The government raised taxes mainly to increase the so-called headroom against their fiscal rules, which many see as an offering to jittery bond markets.

“Despite all the government’s efforts to get through a £26bn package of tax rises, the Office for Budget Responsibility expects the Bank of England to sell £32bn worth of bonds a year until 2029/30.

“These sales risk counteracting the government’s efforts and it is astounding the Treasury has no control or oversight over these sales.

“The Bank itself has estimated these sales have added up to 0.25 percentage points to borrowing costs. Overall, reining in bond market movements cannot be done by fiscal policy adjustments alone, the Bank will also need to change its approach.”

ENDS

Contact

James Rush – james.rush@neweconomics.org

Notes

Bank of England estimates bond sales have added 15 – 25 basis points to gilt yields: https://www.bankofengland.co.uk/monetary-policy-report/2025/august-2025

The New Economics Foundation is a charitable think tank. We are wholly independent of political parties and committed to being transparent about how we are funded.