Updating the local authority funding gap

Local government austerity 2009/10 - 2024/25

23 October 2019

The Councils in Crisis report NEF published earlier this year set out the extent of cuts to local government finances over the last decade, as well as modelling local government funding and demand for services over the next five years. We found that by 2024/25, authorities will face a funding gap of over £25 billion in real terms compared to what they would need to provide services at the level and quality they did in 2009/10. Since then, we have received further details on the 2020/21 local government settlement, including a one-year delay to the reform in the Business Rates Retention System, and have updated the analysis to take this into account.

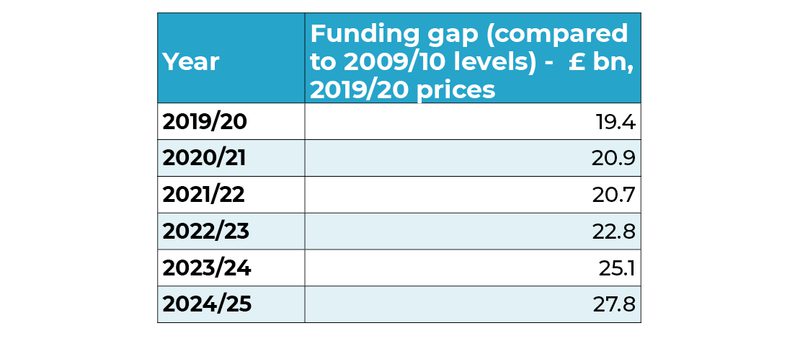

This table shows the size of the updated funding gap between 2019/20 and 2024/25. These figures show the difference between the amount of money councils have available to them, and the cost of providing services at 2009/10 level of service access and quality – before the onset of extreme local government austerity.

The data shows that simply to maintain current levels of service delivery (widely acknowledged as insufficient to address need), an additional £8.4 billion must be found for local government over the next five years. (This is the difference between the 2019/20 funding gap and gap projected in 2024/25.)

Local authorities have responded to austerity and changes to the funding landscape in a range of ways. However, there are clear signs that they are at breaking point as services are declining to an unacceptable level of quality, and they are becoming unable to meet basic needs.

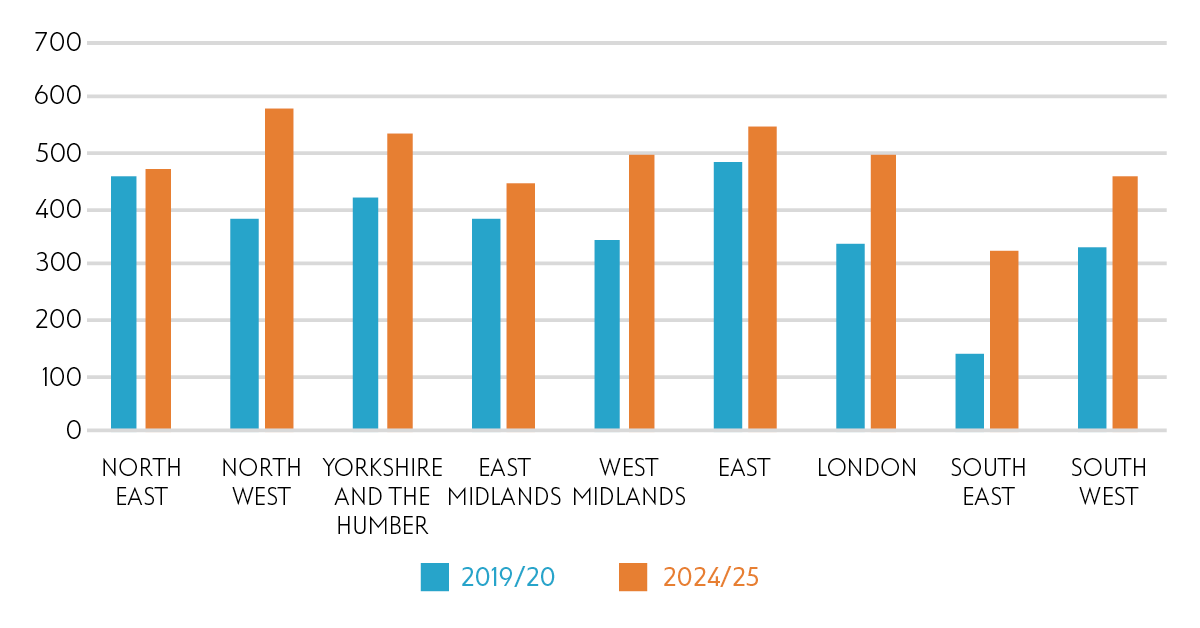

However, not all regions of England face the same funding gap. London, the North West and the South East are expected to experience the biggest widening of the gap. Although London will gain significantly from the move to a higher business rates retention, funding won’t keep up with the significant increases in need across this region. Most other regions are due to lose out from the new business rates retention system.

It is clear that local authorities will be unable to fill this gap without significant changes to the local funding landscape, ensuring that vital local services are properly supported. It is likely this will involve reform to either business rates, council tax or both. It may also involve the introduction of new local taxes or the further devolution of those that are currently national.

Notes

Estimating revenue

Total revenue available to local authorities is the sum of retained business rates, council tax, and government grants (revenue support grant, public health grant, new homes bonus, social care grant, better care fund, winter pressures grant and rural services delivery grant).

We model business rates retained for 2019/20 and 2020/21 assuming the current system is continued. For 2020/21, we assume the governments proposed finance settlement is enacted, including uprating the current settlement funding assessment (which comprises retained business rates and revenue support grant) by the small business rates multiplier, a core council tax referendum principle of 2% and adult social care precept of 2% on top of the core principle, and the rollover of most government grants.

We assume reform of the business rates retention system comes in in 2021/22. At this point, there will be 75% local business rates retention, and we have modelled the system with a 95% safety net and a levy rate of 0.5. We assume at least a 5 year reset period (ie. system is not reset before 2024/25). We project forward historical rates of growth of business rates over the last five years to give expected rates.

We assume the revenue support grant, rural services delivery grant, greater london authority transport rant and the public health grant will be abolished when the new system commences.

We assume council tax principles are continued from 2020/21 and that councils will raise rates by the legal maximum without referendum.

Estimating need

We calculate the cost of providing services at 2009/10 levels of access and quality by uprating the relevant proportion of the 2009/10 funding pot for a range of spending areas: adult social care for working age, adult social care for older adults, children’s social care and other services. We uprate according to relevant demographic pressures (ie. population increases in the relevant age group) as well as cost pressures (ie. increase in minimum wage and general increases in prices) for each year to give the estimate for need.

Topics Local economies Macroeconomics