1.2 million private renters at high-risk of job loss and missing out on income support schemes

New Economics Foundation propose an immediate suspension of private rents and mortgage costs

04 May 2020

Up to 1.2 million renters are at high-risk of having to rely on Universal Credit after losing their jobs or hours and falling through the gaps in the government’s job and income protection schemes, according to a new report published by the New Economics Foundation (NEF) today. The report recommends the Government brings in an immediate suspension of all private rents and residential mortgages for an initial three months to protect against severe financial hardship and housing insecurity.

The government has announced a temporary suspension of evictions but has taken only limited action on the rent which will legally still be due, which is likely to create significant financial hardship for even better paid renters. Housing benefit has been increased marginally for private renters, but many renters will still be pushed into hardship. Private renters were already financially vulnerable prior to the pandemic, with a third of disposable income on average spent on rent (compared with 17% spent by homeowners on mortgage costs), and with more than a third (35%) of private renters already living in poverty.

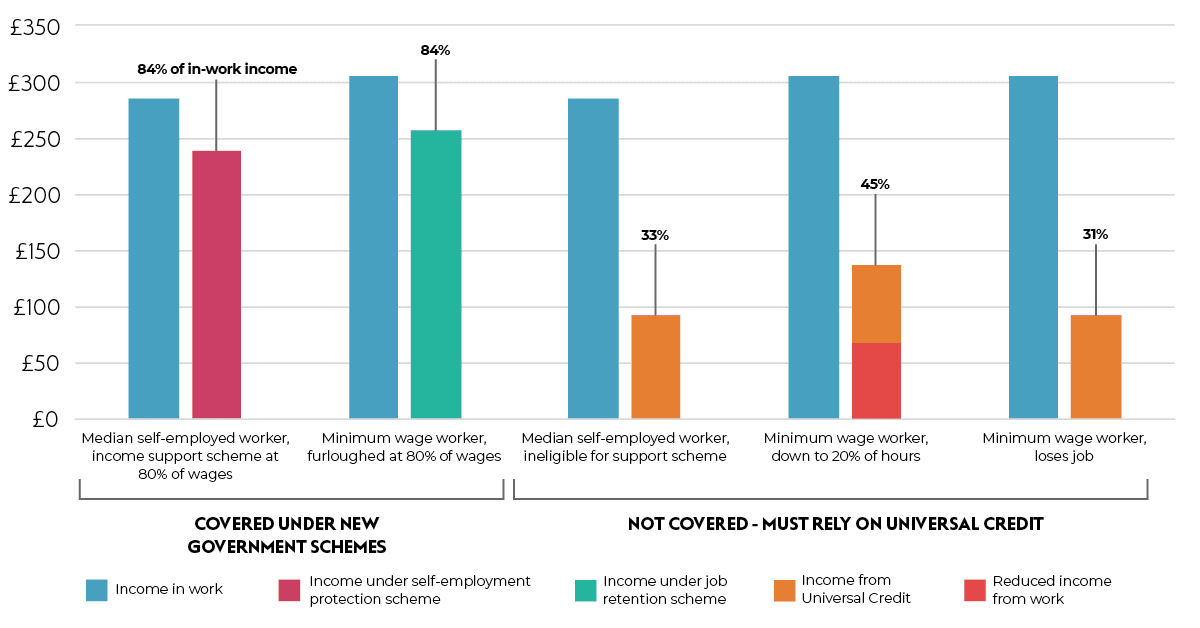

The 1.2 million renters identified in the report are among the 5.6 million workers at highest risk of falling through the gaps in the government’s job and income protection schemes, as highlighted be recent NEF research. These renters will likely have to rely on Universal Credit – NEF modelling in the report shows that a single, full-time minimum wage worker who is forced to rely on UC could face a 45% reduction in their income. For those living in London, this would leave just £55 a week (£238 a month) to pay for all essentials outside rent, such as food and utility bills. With average bills, before food, coming in at £237 a month.

Even relatively well-paid private renters who are eligible for the job retention scheme may struggle to meet basic costs as well. The NEF modelling in the report also shows that a worker on median wages would see their disposable income drop by 16%, on average leaving less than half their salary remaining to meet all other costs of living.

To introduce a rent suspension in a responsible and economically viable way, the report recommends the following steps:

- The Government should bring forward emergency legislation to suspend the obligation to pay any rent during an emergency period, for all private tenants.

- The rent suspension policy should apply to all private renters, including those who are outside the formal economy, for example those who have irregular immigration status.

- The government should implement a mortgage suspension for the same period to protect homeowners and prevent banks from profiting from the crisis. This would also mean mortgaged landlords (61% of landlords) who lose income from the rent suspension would have no mortgage payment obligations. No further interest would be accrued during the mortgage suspension. The report also recommends additional income protection for landlords who rely on their rental income for basic subsistence.

- The Bank of England should introduce low-cost loans to mortgage lenders, to smooth over any cash flow issues caused by the mortgage freeze. Lenders will be deferring a significant income stream, and low-cost loans would allow them to replace these, with the loan paid back over a time period which allows for the deferred income to be recouped from extended mortgage contracts.

The recommended measures would carry only marginal additional cost to the government, with much of the shortfall made up by loans to mortgage providers from the Bank of England, which would eventually be paid back by through an extension of rent and mortgage contracts.

Joe Beswick, Head of Housing and Land at the New Economics Foundation, said:

“Many of those in the private rented sector, a group who were already economically vulnerable before this crisis, are falling through the cracks of the government’s support systems. With many losing a substantial portion of their income in a world where on average one third of income was already spent on rent, the government must act swiftly to prevent renters from going into deep financial insecurity or hardship caused by housing costs. If we are to avoid an eviction crisis from rent arrears following the public health crisis, we must suspend the obligation to pay rent immediately.”

Contact

Sofie Jenkinson, sofie.jenkinson@neweconomics.org, 07981023031

Notes to editors

1) The briefing paper ‘Suspending Rents: How to protect renters from eviction during Covid-19’ is available here: https://neweconomics.org/2020/04/suspending-rents

2) The estimate for renters most at risks is based on new analysis of the ONS Labour Force Survey, ONS. (2020). Labour Force Survey (Q4 2019) (the latest available). When defining ‘key workers’ in the dataset, we follow the approach of Farquharson, Ch., Rasul, I. and Sibieta, L. (2020). Key workers: key facts and questions. IFS, and use the same occupational (SOC-based) definitions of ‘key workers’. But to conduct the analysis of job insecurity among those outside the ‘key’ occupations — the ‘non-key’ workers — we also exclude all public sector workers, given that they are much more likely to be reallocated rather than lose employment.

In defining ‘shutdown industries’ we follow the industry (SIC) based methodology of Joyce, R. and Xu, X. (2020). Sector shutdowns during the coronavirus crisis: which workers are most exposed? IFS. Both ‘key’ and ‘shutdown industry’ classification types are inherently difficult to define precisely therefore should not be seen as definitive. Please see the cited briefings for more details about the approaches and their caveats.

3) NEF analysis based on the Q4 2019 Labour Force Survey (LFS). The LFS shows that there are 6.2 million adults in the UK who are in work and are also private renters – NEF’s analysis shows that 1.2 million of these are at high risk of both losing their job and needing to rely on UC before June.

4) How different people in different jobs/on different contracts are impacted by the current situation

Someone on zero-hours contract who keeps their job but keeps just 20% of hours (Minimum wage)

- A typical minimum wage worker receives £305 in income from work

- If this worker lost 80% of their hours and has to rely on universal credit, they would only get 45% of their original income

Someone on a fixed-term contract loses job (Minimum wage worker)

- A typical minimum wage worker receives £305 in income from work

- If this worker loses their job and has to rely on universal credit they would only get 31% of their original income

Typical self-employed worker

- A typical self-employed worker receives £285 per week in income from work

- If this self-employed worker had to rely on universal credit they would only get 33% of their original income

Weekly net in-work income compared with income after a loss of work for a single adult homeowner over 25 with no children, under new government schemes

5) The New Economics Foundation is a charitable think tank. We are wholly independent of political parties and committed to being transparent about how we are funded.

Campaigns Coronavirus response

Topics Housing & land