Sunak’s support package will leave 23.2 million people making sacrifices on essentials like the weekly shop or replacing clothes and shoes come October

New analysis by the New Economics Foundation shows that 9 million households will be unable to afford the cost of living by £6,500 a year

26 May 2022

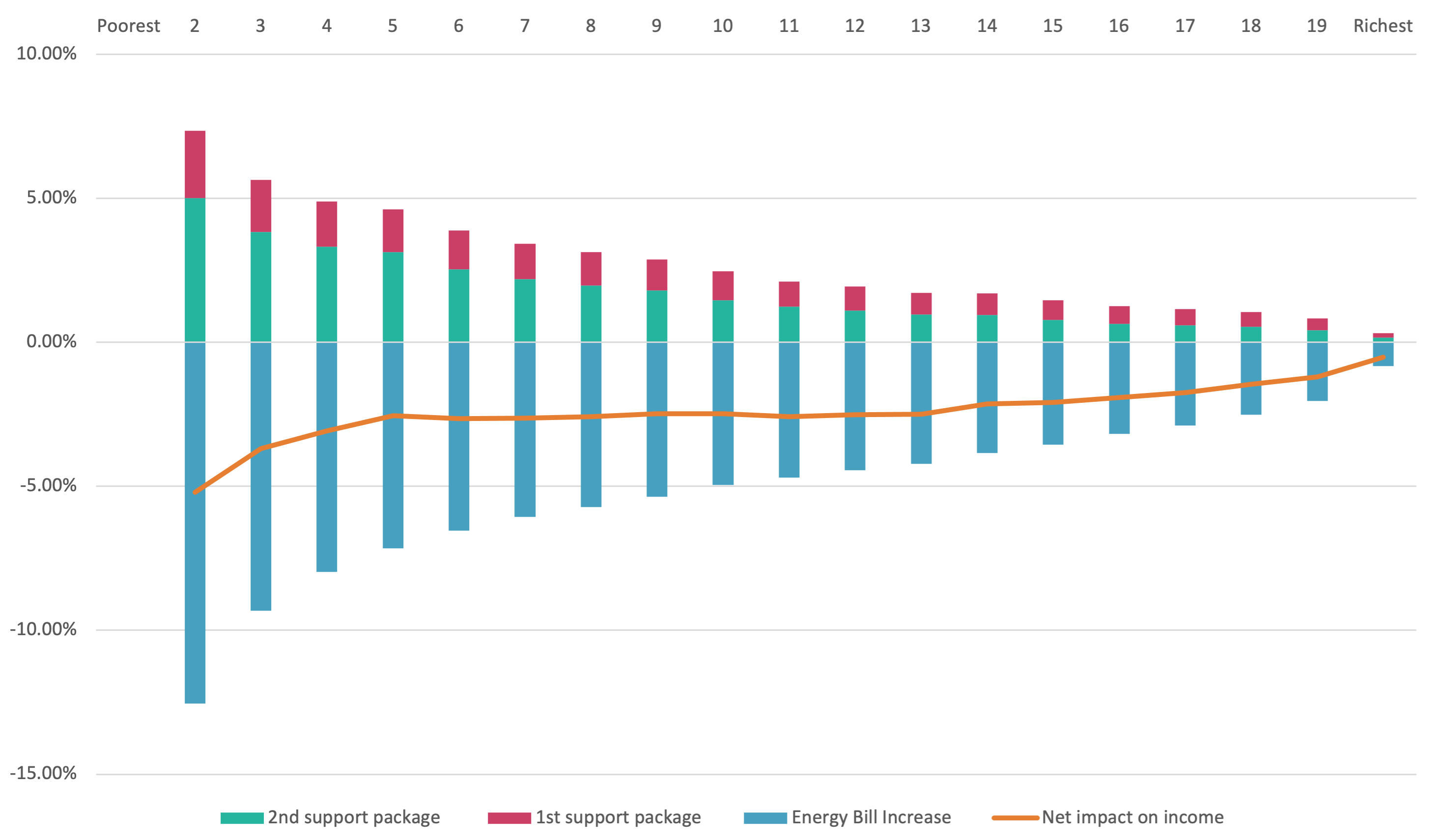

Rishi Sunak’s support package, announced today, will still leave over a third of the population, 23.2 million people, unable to afford the cost of living by £6,500 on average from October, according to new analysis from the New Economics Foundation (NEF). This figure includes 3.6 million (46%) of households with children. Under the proposals announced today, the poorest 10% of households will still lose 10 times more of their income to high energy bills than the richest 5%.

The research uses the Minimum Income Standard (MIS), which is the UK’s leading approach to measuring living standards based on need and is used to calculate the‘real’ Living Wage paid by companies like Ikea and KPMG, and football clubs like West Ham, Liverpool and Everton.

The analysis not only shows the number of people unable to afford the cost of living, but also the extent to which their incomes are falling short. Households with children who cannot afford a good standard of living will miss out by £8,800 a year on average. This leaves families having to make impossible choices between life’s essentials, like putting food on the table or replacing clothes and shoes.

NEF is calling on the chancellor to hold a full emergency budget with long-term policies to address the high cost of living. This would include:

- Alongside increasing benefits by the latest inflation rate, introducing an automatic change to benefits when the energy price cap increases or decreases, to make social security more responsive to the actual cost of living.

- Helping middle-income households by sending a £500 stimulus payment to everyone with an income below £35,000 a year who does not receive means-tested benefits.

- Removing the two-child limit from universal credit, so larger families can afford the cost of living.

- Scrapping the benefit cap.

Sam Tims, economist at the New Economics Foundation, said:

“The chancellor has finally pulled his head out of the sand and listened to calls demanding the government support households struggling with the cost of living. But these policies still leave a third of the population out in the cold and will only last until next year, when inflation and energy bills will still be sky-high.

For months families have been consumed by anxiety, watching bills go up and worrying how they will get through the winter ahead. It doesn’t have to be like this. Making permanent changes to our social security system, and a mass programme of home insulation would stop families having to make impossible decisions.”

Miatta Fahnbulleh, chief executive of the New Economics Foundation, said:

“Families on benefits that have been cut to the bone needed a £2000 income boost to reflect the real cost of living. A one-off payment this year provides some relief but does little to fix our broken safety net for those at the sharp end of this crisis. We need a Living Income: a bold new way of doing income support that would set a level below which no one can fall, whether in or out of work. Instead of leaving energy companies to pocket billions in profits, a higher windfall tax would provide more help to offset the price cap rise in October for the average family. This could also put money towards a Great Homes Upgrade to insulate millions of homes and get the cost of energy bills down for good.”

Notes

The New Economics Foundation is a charitable think tank. We are wholly independent of political parties and committed to being transparent about how we are funded.

To measure the cost of living we use the Minimum Income Standard (MIS) as calculated by Loughborough University’s Centre for Research in Social Policy. Household budgets for different family types are calculated based on what the public thinks is needed for an acceptable standard of living. We can then compare these budgets to people’s incomes, creating an accurate picture of how many people will be unable to afford the cost of living.

Using the latest Bank of England forecasts and Office for National Statistics data on inflation for different items we have estimated the value of the MIS for April 2022 using budget breakdowns from the MIS in 2021. We base our inflation on the Bank of England’s forecast of 7.7% in Q2, but account for the 54% increase in the energy price cap.

Poorest 10%* spending 10x more of their income on energy bills than the richest as % income even after support

Change (%) in annual after housing cost income in October 2022 as a result of chancellor’s support package announcements compared to energy bill increase since April 2021

Source: NEF analysis of the Family Resources Survey using the IPPR tax-benefit model, energy bill increase based on the fuel component of the minimum income standard. 1st support package refers to the £200 energy bill rebate and £150 council tax rebate. 2nd support package refers to the £650 payment to benefits, extra £200 energy bill rebate, £300 payment to pensioners and £150 payment to disabled people.

Note: Bottom 5% are excluded due to known issues with data reliability

*Poorest 10% refers to 2nd vigntile as the bottom 5% are excluded due to known issues with data reliability

Household Type |

Percentage of households below MIS |

Annual amount under MIS |

Couple children |

36% |

£7,870 |

Couple no children |

19% |

£5,330 |

Couple pensioner |

12% |

£3,310 |

Single children |

77% |

£7,717 |

Single no children |

43% |

£3,141 |

Single pensioner |

23% |

£1,750 |

Source: NEF analysis of the Family Resources Survey using the IPPR tax-benefit model, energy bill increase based on the fuel component of the minimum income standard. Multiple benefit unit households not included in table.