Richest households will gain 10x more than the poorest from income tax cut

For the same cost of a 1p cut to income tax, the government could increase universal credit by £20 a week and lift half a million people out of poverty, according to analysis from the New Economics Foundation

22 November 2023

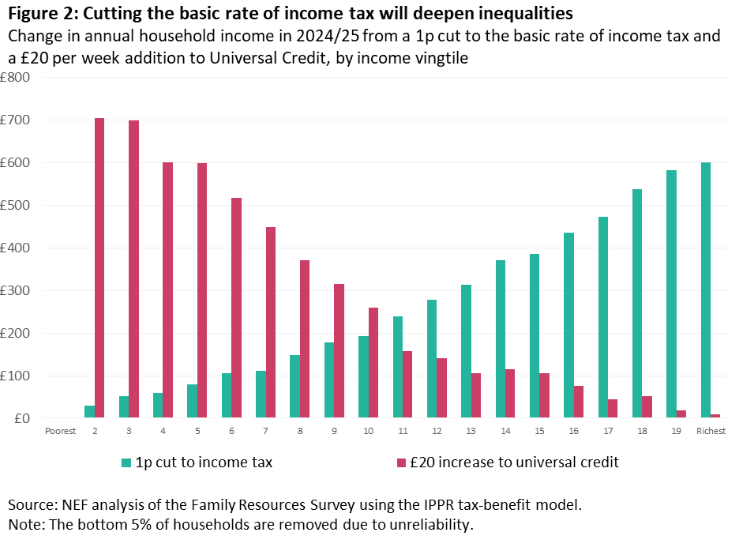

Cutting the basic rate of income tax by 1p would deepen inequalities, with higher income households gaining 10 times more than the bottom quarter, according to analysis from the New Economics Foundation published today.

If the chancellor announces a 1p cut to income tax in the autumn statement, it will amount to an extra £530 a year for households with the top quarter of incomes. For the bottom quarter of households it will only amount to an extra £50 a year.

Sam Tims, senior economist at the New Economics Foundation said:

“At a time when households across the country are struggling with the cost of living crisis, it is extremely concerning to see the government looking to offer a tax giveaway that will fuel inequality and make us all poorer in the long run.

“It is the poorest families that have suffered the most over the last two years of high inflation and interest rates, but the now government is ignoring them.

“The Chancellor should instead be choosing to make our economy fairer and stronger by boosting social security, bringing good jobs to our high streets and securing long-term investment in our public services.”

A 1p cut to income tax will cost the government £6.3bn in 2024/2025. It would cost the government £6.4bn to reinstate the £20 uplift to universal credit, which would increase the incomes of the lowest quarter of households by £650 a year. This would lift 600,000 people out of relative poverty (where poverty is measured relative to median incomes).

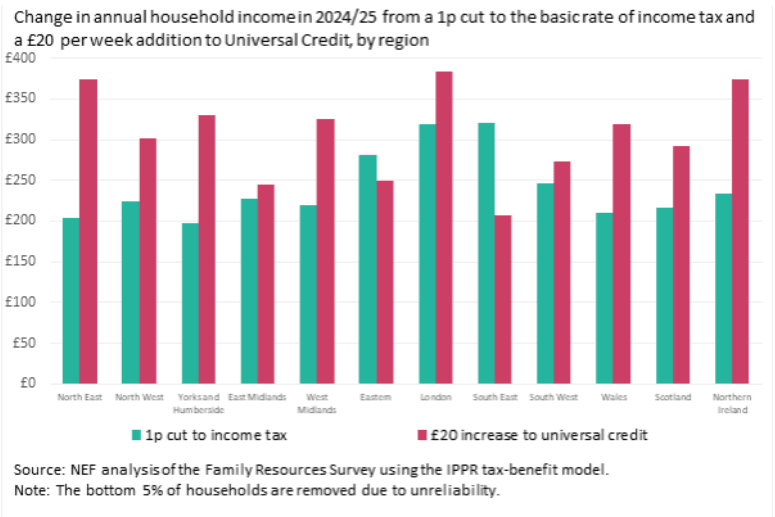

The research also found that cutting income tax would exacerbate regional inequalities, with households in London and the South East of England gaining 50% more than households in the North. Whereas if the government increased universal credit by £20 a week, households in the North would be £320 a year better off, compared to households in the South who would be £190 a year better off. Because of high living costs and rates of poverty in London, households would gain £370 from the reintroduction of the uplift.

Notes

The New Economics Foundation is a charitable think tank. We are wholly independent of political parties and committed to being transparent about how we are funded.

Figure 1

Figure 2