Up to 5.6 million people are at high risk of losing work and falling through the cracks in new government support systems

New Economics Foundation propose a weekly minimum income guarantee to ensure all workers have support during the crisis

11 April 2020

Up to 5.6 million workers are at high risk of losing their jobs or hours and being unable to access the support they need, according to new analysis published by the New Economics Foundation today. Within this number, 1.6 million workers are at especially higher risk as they work in industries that have been directly affected by the government shutdown, such as restaurants and non-food retail shops.

The analysis looked at the number of people who are at especially high risk of missing out on the government’s ‘job retention’ and ‘self-employed income protection’ schemes. Employees that are likely to miss out from the job retention scheme include those that see a cut in hours, or who are made redundant rather than being furloughed. The self-employed income protection scheme will miss the newly self-employed, as well as those that are incorporated as companies. But even those self-employed who will be eligible will not receive any support until June 2020.

All workers that meet one of the following characteristics are at high risk of missing out on new government protections: fixed-term contracts, zero-hours contracts, those who were already underemployed by their employer and the self-employed.

Based on analysis of the Labour Force Survey, NEF economists identified all workers that fitted these characteristics prior to the economy lockdown. The analysis showed that outside the public sector and occupations identified as ‘key’ by government, there were 5.6 million workers in insecure employment. Within this number, 1.6 million worked in industries that were directly affected by the government’s lock down.

Many of these vulnerable workers are likely to be among the 1 million people who applied for Universal Credit during the last two weeks of March. But even those workers who are able to access support via the UC system will likely have to wait many weeks, if not months, to receive their full payment. This will cause severe financial hardship for those who have lost work as a result of social distancing measures and are trying to do the right thing.

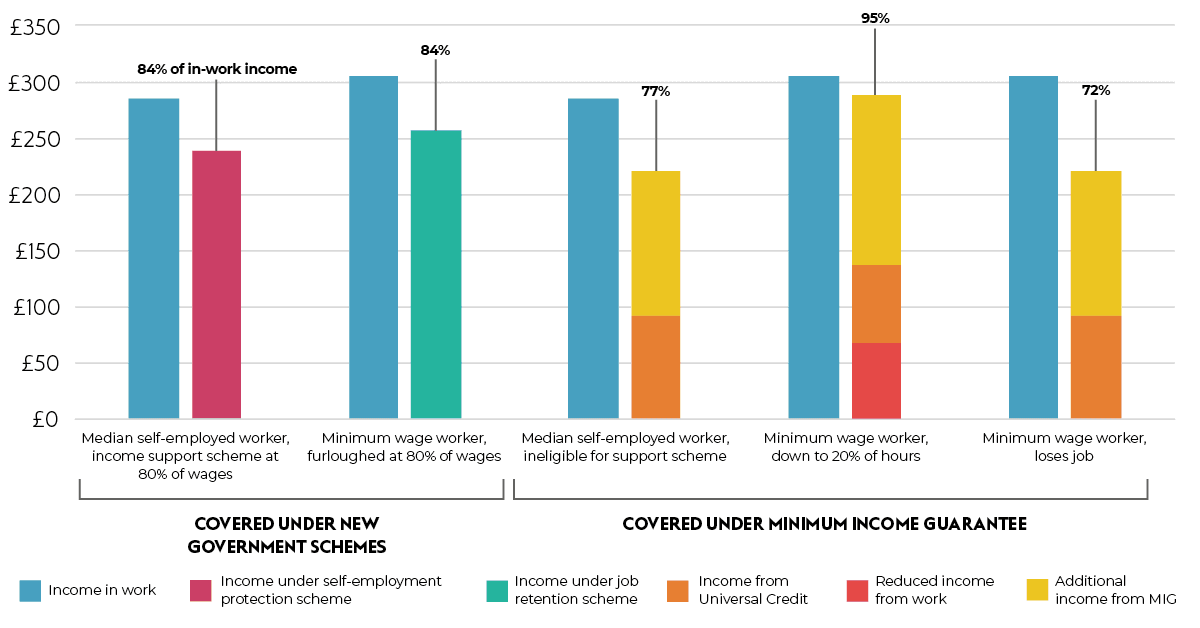

The New Economics Foundation’s recent work set out a proposal for a non-conditional and non-means tested (at the point of access) Minimum Income Guarantee (MIG) of £221 per week per working-age adult, which would offer support to a wider group of people and mean fast payment via the UC advanced payment system.

The MIG scheme would provide support for those who do not qualify for the two government support schemes as well as those that will have to wait for support, such as the self-employed. As with the government’s existing two schemes, the MIG scheme, would be capped at £2,500 a month, meaning that while anyone can apply, where a claimants income rises above the threshold they would have to pay back the difference in the 2020/21 tax year. Based in NEF modelling using data from the Department for Work and Pensions and Office for National Statistics, the MIG is estimated to cost between £13 and £20 billion, less than half the estimated costs of the government’s current protection schemes.

Christian Jaccarini , Economist at the New Economics Foundation, said:

“This crisis is exposing the precarious situation faced by millions of people who, even before the virus-induced economic shock, were experiencing low pay and job insecurity. And so, in turn, it is exposing critical gaps in the UK’s welfare safety net. What is clear is that you cannot rebuild in a week when you’ve spent a decade destroying – our social security system is not fit for purpose in this crisis and will not be for the next. We urgently need a safety net that allows people to access the support they need for the basics in life whether in a global crisis or a personal one.”

Lukasz Krebel, Assistant Researcher at the New Economics Foundation, said:

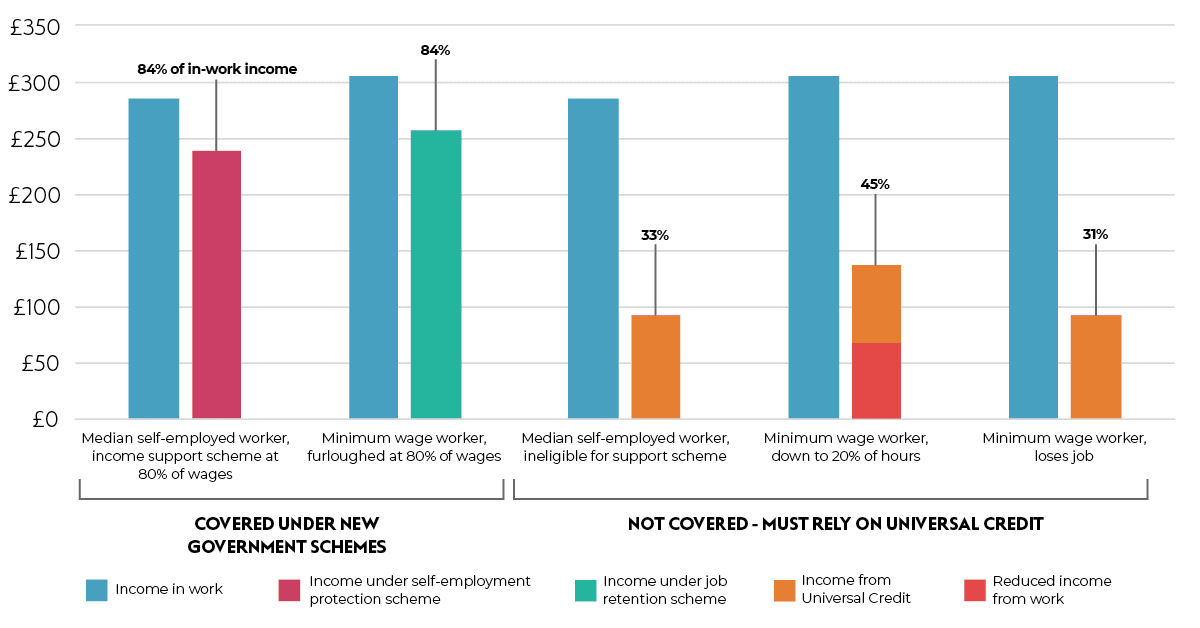

“Those who do not qualify for the 80% income protection schemes must rely on a welfare system that is overwhelmed, and if their claims do get processed, they will have to survive on a mere £90 a week — equivalent to barely one third of a full time adult being paid the minimum wage — plus meagre top-ups for children and housing. The average self-employed is likely to see a 67% drop in disposable income compared to being in work, a loss of almost £200 a week. And an adult working full-time on the minimum wage is likely to see a 69% drop in income, a loss of over £210 per week. This means many will struggle to be able to cover their basic needs –our proposal of a Minimum Income Guarantee of would provide a decent income for anyone that needs it, including those already on UC, and those awaiting payments – ensuring that people can have security and dignity in these extraordinary times.”

Contact

Sofie Jenkinson, sofie.jenkinson@neweconomics.org, 07981023031

Notes to editors

1) The estimate for workers most at risks is based on new analysis of the ONS Labour Force Survey, ONS. (2020). Labour Force Survey (Q4 2019) (the latest available). When defining ‘key workers’ in the dataset, we follow the approach of Farquharson, Ch., Rasul, I. and Sibieta, L. (2020). Key workers: key facts and questions. IFS, and use the same occupational (SOC-based) definitions of ‘key workers’. But to conduct the analysis of job insecurity among those outside the ‘key’ occupations — the ‘non-key’ workers — we also exclude all public sector workers, given that they are much more likely to be reallocated rather than lose employment.

In defining ‘shutdown industries’ we follow the industry (SIC) based methodology of Joyce, R. and Xu, X. (2020). Sector shutdowns during the coronavirus crisis: which workers are most exposed? IFS.. Both ‘key’ and ‘shutdown industry’ classification types are inherently difficult to define precisely therefore should not be seen as definitive. Please see the cited briefings for more details about the approaches and their caveats.

2) The Minimum Income Guarantee proposed by NEF(https://neweconomics.org/2020/03/building-a-minimum-income-protection) ‘ is a weekly payment worth £221 per week which is equal the value of the 2019 minimum income standard estimated by the Joseph Rowntree Foundation for a single adult, excluding any rent, mortgage or childcare costs. https://www.jrf.org.uk/report/minimum-income-standard-uk-2019

For existing claimants, the top-up to their current benefits will be automatic and will not interact with the benefit cap. For new claimants, the payment will be made through the advance payment system for UC. This facility will be used to make this main adult payment while foregoing an assessment period and therefore the five-week wait. This will enable the Department for Work and Pensions (DWP) to process claims much faster than at present, helping them to deal with the increased demand from rising unemployment over the coming week.

Initial entitlement to the MIG will be extended to all working age adults who wish to apply via the advanced payment system in UC. Claimants can also apply and receive their MIG payments while they wait for their entitlement from either the job retention scheme or the self-employed income support scheme. Any backdated payments from these schemes will be made net of payments already received under the MIG. Once someone is in receipt of either the job retention scheme or the self-employed income support scheme, they will no longer be able to receive payments from the MIG. Workers who still have some level of earnings and are not using the employee and self-employed schemes will also be entitled to the MIG. For anyone who receives an MIG payment which takes their net income above £2,500 per month after taking into account any other earnings from work, the value of income above this threshold will be repaid in additional tax in the 2021/22 fiscal year.

For every additional 500,000 claimants of the MIG, the marginal cost above what they would have received from the present benefit system would be a little under £0.5 billion per month, or less than £1.5 billion for three months. The latest forecasts from the DWP for an increase in the claimant count would imply a total cost for the MIG of around £4.5 billion per month, or little under £13.5 billion for three months. However, the latest DWP forecasts are likely to prove an underestimate of the likely demand for an MIG, with the final cost likely to be far closer to £20 billion over three months.

3) Comparing how different people in different jobs/on different contracts are impacted by the current situation and how they would be impacted if a MIG scheme was put in place

Someone on zero-hours contract who keeps their job but keeps just 20% of hours (Minimum wage)

- A typical minimum wage worker receives £305 in income from work

- If this worker lost 80% of their hours and has to rely on universal credit, they would only get 45% of their original income

- But with NEF’s Minimum Income Guarantee the minimum wage worker would still get 95% of their original income

Someone on a fixed-term contract loses job (Minimum wage worker)

- A typical minimum wage worker receives £305 in income from work

- If this worker loses their job and has to rely on universal credit they would only get 31% of their original income

- But with NEF’s Minimum Income Guarantee the minimum wage worker would still get 72% of their original income

Typical self-employed worker

- A typical self-employed worker receives £285 per week in income from work

- If this self-employed worker had to rely on universal credit they would only get 33% of their original income

- But with a NEF’s Minimum Income Guarantee the self-employed worker would still get 77% of their original income

Weekly net in-work income compared with income after a loss of work for a single adult homeowner over 25 with no children, under new government schemes

Weekly net in-work income compared with income after a loss of work for a single adult homeowner over 25 with no children, under new government schemes plus NEF’s Minimum Income Guarantee

4) The New Economics Foundation is a charitable think tank. We are wholly independent of political parties and committed to being transparent about how we are funded.