Two in five families will be unable to afford a decent standard of living by the next general election

Households unable to afford a decent living will fall short by £10,000 a year on average, according to new analysis by the New Economics Foundation

13 December 2022

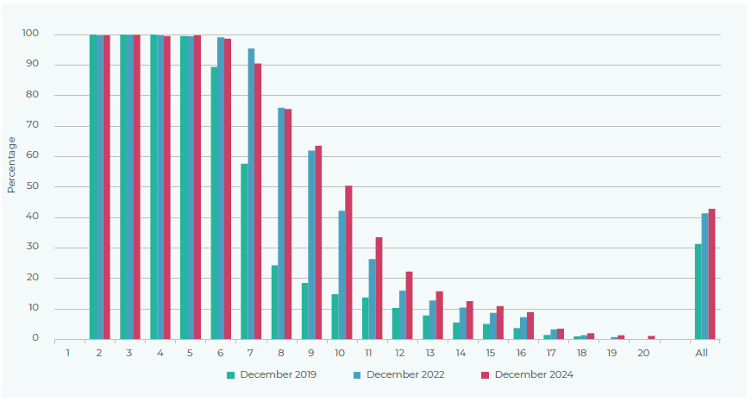

By the next general election, 43% of families (12.5 million households, 30.6 million people) will be unable to afford the cost of essentials, like putting food on the table or replacing clothes, according to new analysis by the New Economics Foundation. This is an increase of 12 percentage points (3.6 million families, 8.9 million people) between the 2019 general election and December 2024.

The research uses the Minimum Income Standard (MIS), which is the UK’s leading approach to measuring living standards based on need and is used to calculate the‘real’ Living Wage paid by companies like Ikea and KPMG, and football clubs like West Ham, Liverpool and Chelsea.

The analysis shows the 12.5 million families unable to afford the cost of living by December 2024 includes 88% of single parents and 50% of working families with children. The average shortfall for families falling short of a decent standard of living standard will have risen from £6,200 a year as of December 2019 to £10,000 by December 2024.

NEF is calling for universal credit (UC) to be replaced by a new social security system, a national Living Income. A national Living Income would set an‘income floor’ benchmarked against the MIS, below which no one can fall whether they are in or out of work.

Under this proposal, over two thirds of the population would see their disposable incomes rise:

- For the poorest families, incomes would rise by more than 50% (£500 a month) on average

- For middle-income families, incomes would increase 9% (£200 a month)

- For single parents, 18% (£270 a month)

- For out-of-work families with children, 36% (£540 a month)

- For single people, 8% (£110 a month)

- For severely disabled people, 32% (£740 a month)

A national Living Income requires a number of recommendations to be implemented in the next parliament, including:

- A guaranteed minimum income of at least 50% of MIS after housing and childcare costs (AHCC). This compares to 35% and 33% of MIS (AHCC) for single adults and couples over the age of 25 (respectively) on UC.

- Alignment of tax and income protection around a new guarantee that no one pays tax or has benefits withdrawn until their income reaches 100% of the MIS (AHCC) for a single adult, including reform to personal tax allowances and work allowances.

- A universal national allowance of £187 a month paid to almost everyone in the country as a new pillar of income protection for all, and making up part of the 50% of MIS guarantee.

- Additional payments to ensure that disabled people and those unable to look for work in the near future receive up to 100% of the MIS (AHCC) in income support.

- Enabling auto-enrolment onto the NLI so that means-tested income protection is paid automatically when incomes fall in the same way that tax contributions rise when incomes go up, and eliminating the five-week wait.

- Scrapping existing caps, limits and sanctions including the benefit cap and the two-child limit.

NEF estimates that implementing the full national Living Income reforms for the first parliament would cost £70.6bn per year in 2021/22 prices, with an initial package of reform costing £25.3bn. The research shows that the package could be funded through a combination of aligning headline rates and removing reliefs and allowances across capital gains; extending national insurance contributions to all types of income; introducing a flat rate of relief on pensions; equalising rates of dividend tax with income tax; and scrapping the much criticised entrepreneurs’ relief in capital gains tax.

Sam Tims, economist at the New Economics Foundation, said:

“A decade of cuts, freezes, caps and haphazard migration between systems has left the UK with one of the weakest safety nets among developed countries. Millions of families were already living in avoidable deprivation and hardship but as we enter the greatest living standards crisis on modern records, the day-to-day experience of low-income families is set to become even more desperate.”

“We need a bold new way of providing income support that will help all people deal with the challenges presented by the fast-changing world we’re living in. A national Living Income would set an income floor that is enough to meet life’s essentials, which no one can fall below whether they are in or out of work.”

Contact

Becky Malone /becky.malone@neweconomics.org /07925950654

Notes

The full report The National Living Income: Guaranteeing a minimum income for all is available here.

The New Economics Foundation is a charitable think tank. We are wholly independent of political parties and committed to being transparent about how we are funded.

NEF analysis has been conducted using the IPPR tax and benefit model based on data from the Family Resources Survey (FRS), the forecasts for key economic aggregates are provided by the Office for Budget Responsibility, population estimates are from the Office for National Statistics and the‘minimum income standard’ basket of goods and services based on the work by the Joseph Rowntree Foundation and the Centre for Research and in Social Policy.

Our policy modelling on the national living income is designed to represent the long run effects of social security reform. We model results on labour market and economic data for the 2021/22 financial year, on the basis that this is likely to be the closest year to ‘normal’ economic activity at any point in the first half of the 2020s, with the preceding year overly affected by the pandemic, and the following years affected by high inflation and recession. However, the tax and benefit system (prior to any recommended reforms) represents the latest schedules as of the 2022 Autumn Statement, except that UC is assumed to be fully rolled out, in order to future proof our results.

Estimates for tax receipts are based on NEF analysis and work by IPPR, Resolution Foundation and Advani and Summers.

Figure 2.6: 43% of households won’t be able to afford a decent standard of living by the next general election

Estimated proportion of households falling below the the MIS after housing and childcare costs (AHCC) in December 2019, December 2022 and December 2024 respectively, by income vingtile

Source: NEF analysis of the Family Resources Survey (FRS) using the IPPR tax-benefit model, April 2023 and 2024 MIS estimates uses OBR inflation forecasts accounting for the energy price guarantee. Note: The bottom 5% of households are removed due to unreliable data in the FRS. Grossing is applied at the household level. Changes to capital gains thresholds not included in analysis.